Cost of Boat Insurance in South Carolina

Home insurance can offer some coverage for your boat, but it is often limited to $1,000. Boat insurance costs range from $300 to $600 a year—a small price to pay for the protection it provides. For example, last year, 151 SC boating accidents resulted in $2.9 million in damage. That’s an average of about $19,000 per accident.

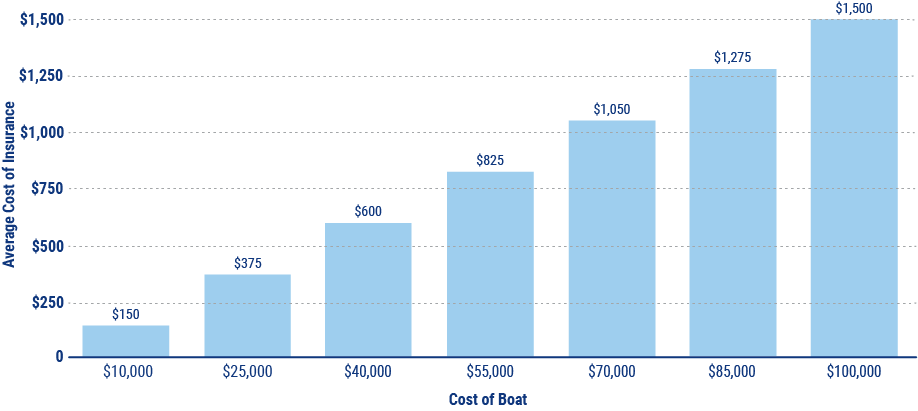

Average Cost of Boat Insurance Per Year