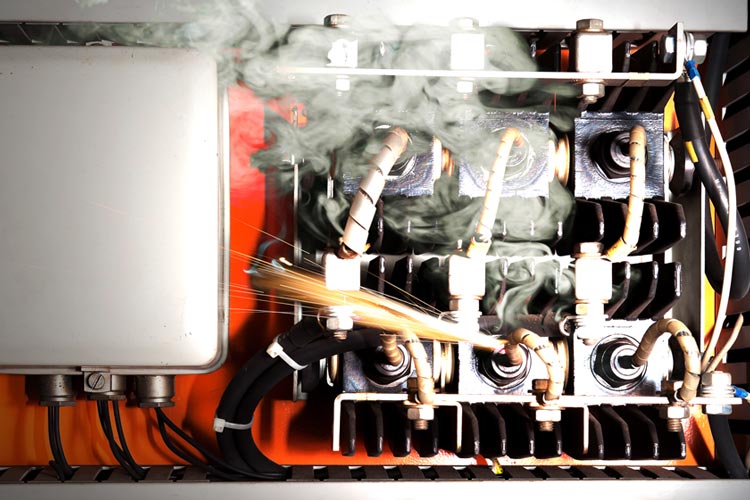

A new home brings many things with it, and unfortunately one of them could be a disaster. So what happens if electrical damage occurs in your brand-new home due to bad installation? Who's responsible and who pays?

Though your South Carolina independent insurance agent can help protect you with the right homeowners insurance, it's important to know the answer to this question first. Here's a closer look at who's responsible in this unique scenario.

Who's Responsible If Electrical Damage Occurs in My New Home?

As the homeowner, you'd have a responsibility to file a claim through your homeowners insurance. Of course, if the electrical damage occurred due to bad installation, it's not technically your fault, but you'd still need to file a claim anyway. Fortunately you should be reimbursed for the damage by your insurance company.

How to Protect Yourself from Future Electrical Fires

Before you worry about who's responsible for damage to your home caused by bad electrical wiring, etc., first it's important to take measures to prevent it from happening at all.

According to the US Consumer Product Safety Commission, more than 50% of electrical fires could be prevented with a few small steps.

Follow these simple tips to protect your home from electrical fires and damage:

- Be safe with extension cords: Don't use extension cords or multi-outlet converters for appliances that use a lot of power like dishwashers, washers, dryers, refrigerators, etc. Instead, plug all your major appliances directly into a wall outlet.

- Be safe with outlets: Don't plug more than one heat-producing appliance into an outlet at a time. If you rely heavily on extension cords, consider adding more outlets to your home with the help of a qualified electrician.

- Be safe with power strips: Power strips only add additional outlets, they do not change the amount of power being received from the outlet. Educate yourself on how many watts your outlets can handle before you plug too many things into a power strip.

- Be safe with plugs: Never force a plug into an outlet. Make sure to only ever insert three-pronged plugs into outlets that are designed for them and never remove the third prong.

- Be safe with bulbs: Always check your lamp and other lighting fixtures' wattage requirements. Never use light bulbs with higher than the recommended wattage.

Taking the time to electric fire-proof your home can save you from ever having to file a claim through your insurance or deal with damage in the first place.

Do I Have to Cover the Electrical Damage Myself?

Well, your homeowners insurance policy would be covering the electrical damage if your claim was approved. Your homeowners insurance would cover damage to your home's structure or foundation as well as to your personal belongings up to your policy's limit. You'd first have to pay your deductible amount out of pocket, though.

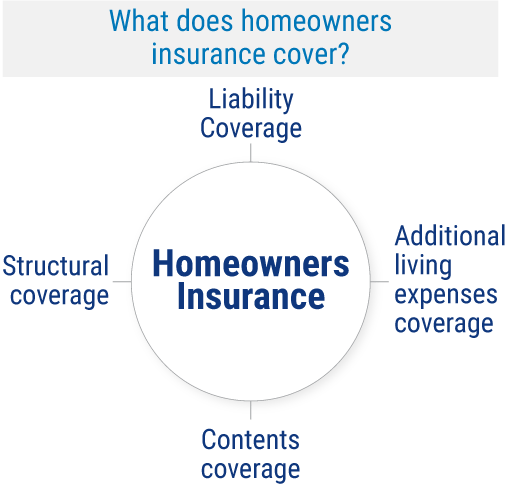

What Does Homeowners Insurance Cover in South Carolina?

Your homeowners insurance covers many disasters beyond just electrical damage. Your coverage is designed to protect not only physical property, but you and your family as well.

Homeowners insurance in South Carolina comes with these core protections:

- Liability coverage: Homeowners insurance reimburses for legal costs like attorney and court fees if you get sued by a third party for claims of property damage or bodily injury.

- Additional living expenses: Homeowners insurance also reimburses for unexpected costs if you have to live somewhere else while your home gets repaired from damage caused by a covered peril.

- Contents coverage: Homeowners insurance includes protection for your personal property like knickknacks, furniture, etc. from covered perils like fire, theft, etc.

- Structural coverage: Homeowners insurance also includes protection for your home's physical structure and foundation from covered perils like vandalism, fire damage, lightning, etc.

A South Carolina independent insurance agent can easily get you equipped with all the homeowners insurance you need to protect against electrical damage and much more.

What Doesn't Homeowners Insurance Cover in South Carolina?

Your standard homeowners insurance policy may not include coverage for certain perils you're concerned about.

South Carolina homeowners insurance doesn't cover the following:

- Earthquakes or floods: You'd need separate policies to cover damage to your home caused by earthquakes or natural flooding.

- Insect damage: Your homeowners insurance won't protect your home against insects or infestations.

- Intentional harm: Your homeowners insurance's liability coverage won't protect you against lawsuits related to causing intentional harm to someone else or their property.

- War damage: Your homeowners insurance doesn't cover damage to your home caused by war.

- Maintenance losses: Your homeowners insurance also won't cover routine maintenance costs.

Since South Carolina can be prone to flooding, ask your independent insurance agent about flood insurance to protect you from damage caused by sources of natural flooding, like hurricanes.

What Are the Biggest Risks for Homeowners in South Carolina?

When shopping for homeowners insurance, it’s helpful to know the most common risks to anticipate needing protection for in your area. In South Carolina, these are:

- Hurricanes: Luckily homeowners insurance will protect your home from damage caused by strong winds or hail from hurricanes.

- Tornadoes: Homeowners insurance protects your home against wind damage stemming from tornadoes as well.

- Wildfires and residential fires: Homeowners insurance in South Carolina also protects against damage caused by many types of fires, including wildfires and residential fires.

- Flooding and water damage: Homeowners insurance covers some sources of water damage, including busted plumbing, but for flooding caused by hurricanes or other natural sources, you'd need a flood insurance policy.

- Severe storms: Many types of severe storms, including the strong thunderstorms South Carolina is prone to, are covered by homeowners insurance also.

Homeowners insurance covers lightning strikes and fires that may result from them. Talk to your South Carolina independent insurance agent about all the ways your policy protects your home against these common disasters in your state.

Will My Home Insurance Rates Be Affected Even If I Didn't Cause the Electrical Damage?

Your rates could increase even for a claim that wasn't your responsibility, fault-wise. That's why you may want to consider whether filing a single claim is worth the risk of your premiums rising, as well as paying the cost of your deductible out of pocket. If the electrical damage to your home wasn't extensive, it might not be worth it to go through your insurance.

Just one property damage claim could increase your home insurance rates by an average of 9%.

That's also why following the tips above to prevent electrical fires from ever occurring can help keep your rates low.

Why Choose a South Carolina Independent Insurance Agent?

South Carolina independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut the jargon and clarify the fine print so you know exactly what you’re getting.

South Carolina independent insurance agents also have access to multiple insurance companies, ultimately finding you the best home insurance coverage, accessibility, and competitive pricing while working for you.

Author | Chris Lacagnina

https://www.cloverelectric.com/how-afcis-prevent-electrical-fires#:~:text=The%20National%20Fire%20Protection%20Association,Fault%20Circuit%20Interrupters%20(AFCIs).

https://safeelectricity.org/avoid-electrical-fires-home/

https://money.cnn.com/2014/10/19/real_estate/homeowners-insurance-claims/index.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.