If you own a property in a southern state, several risks come with the heat of the day. Where you place your protection matters and can make a difference in your finances. South Carolina homeowners insurance may have coverage for your property even after a fire loss.

A South Carolina independent insurance agent has a network of carriers, giving you options on policy and premium. They'll do the shopping for free too, making it super-easy. Connect with a local expert to get started in minutes.

What Does Homeowners Insurance Cover in South Carolina?

Your South Carolina homeowners insurance will have basic protection against fire, severe weather, natural disasters, theft, and vandalism. Each limit is preselected to meet your needs as a homeowner.

How your home coverages are broken down:

- Dwelling limit: Pays for the replacement or repair of your home itself when a covered claim occurs.

- Personal property: Pays for the replacement or repair of your personal belongings.

- Personal liability: Pays for bodily injury, property damage, or slander claims against a household member.

- Additional living expenses: Pays for your temporary stay at another property when a claim renders your home unlivable.

- Medical payments: Pays for the first $1,000 - $10,000 of a medical expense when a third party gets injured on your property.

Can I Purchase Homeowners Insurance after a Fire in South Carolina?

When it comes to obtaining home insurance after a significant loss like a fire, there are options. Each carrier has guidelines for what they allow as far as prior claims.

South Carolina catastrophes that impact your home the most:

- Hurricanes and tropical storms

- Ice storms and freezing

- Burglary and other property crimes

- Wildfires and residential fires

- Flooding and other water damage

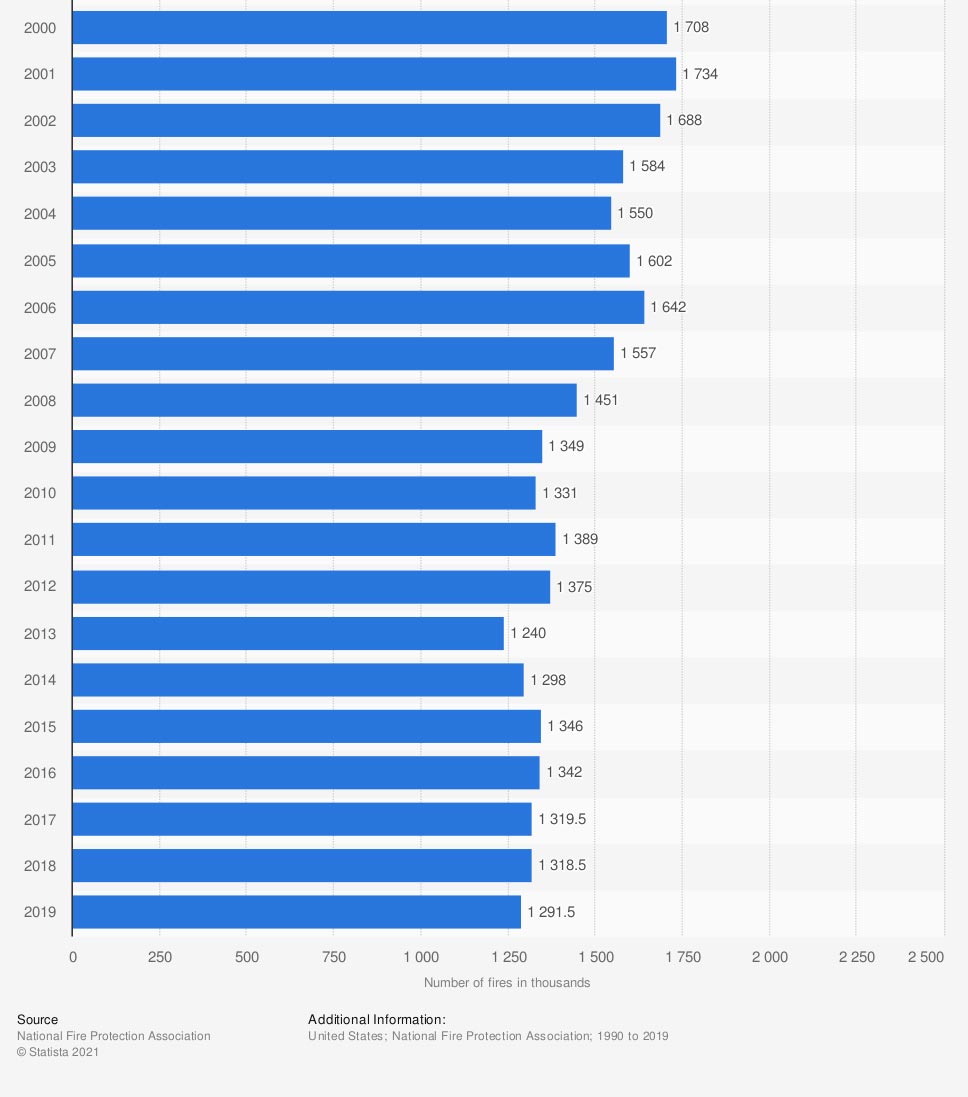

Total number of reported fires in the US

If you experience a fire in your home, it can be devastating, not only from a financial perspective, but from an emotional one as well. This makes having the proper coverage vital.

Does South Carolina Home Insurance Protect against Fires?

Most homeowners policies come with protection against a fire automatically. Since there are numerous carriers, some may have different coverage options.

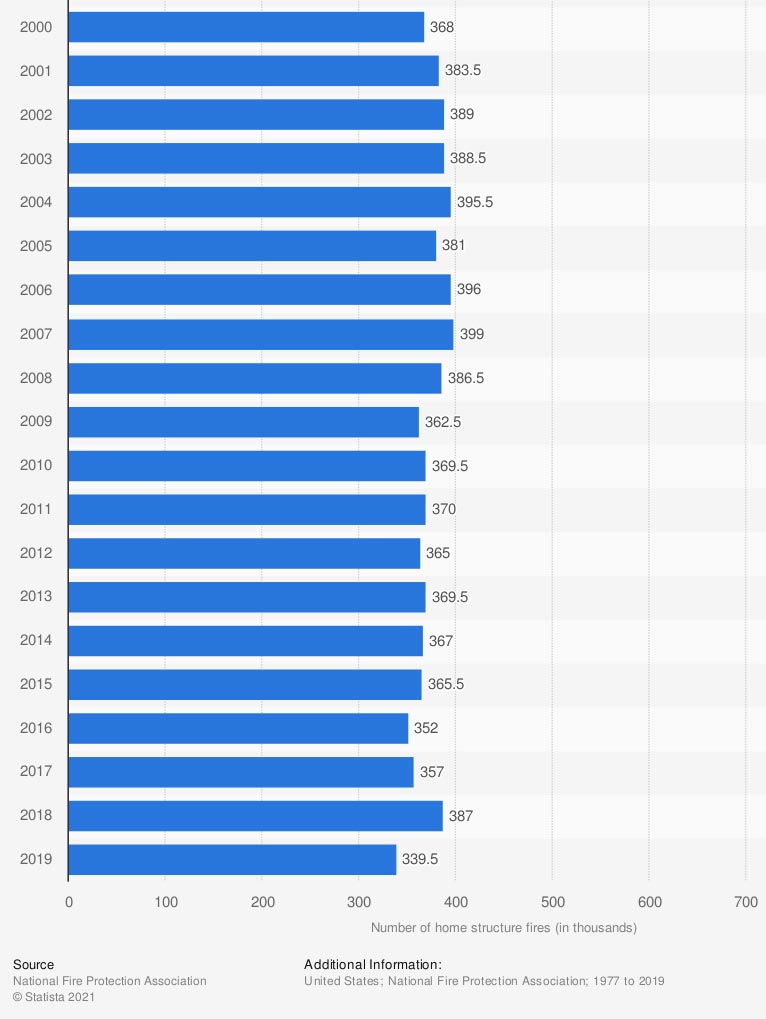

Total number of reported home structure fires in the US

When you have a fire loss, there are many moving parts that you'll need coverage for. This includes buying new clothes, and where your family will stay until your home gets repaired. All of those things add up and, without proper protection, could cost a fortune.

Will My South Carolina Home Location Impact My Rates?

Carriers look at varying risk factors when calculating your home insurance premiums. Where your home is located in one of them. Check out the average annual cost of home insurance:

- National average home insurance premium: $1,211

- South Carolina average home insurance premium: $1,269

Things like which flood zone you're in and local crime rates are used. If you're in an area that has severe weather, that's taken into account as well.

How a South Carolina Independent Insurance Agent Can Help

It can be challenging when you're trying to find a homeowners insurance policy after a fire loss. Multiple options could make sense but may be confusing to understand. Fortunately, you're not alone, and a trusted adviser can help for free.

A South Carolina independent insurance agent does the shopping through their network of highly rated carriers. This makes finding coverage for an affordable price even better. Connect with a local expert on trustedchoice.com for tailored protection today.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/203760/total-number-of-reported-fires-in-the-united-states/

https://www.statista.com/statistics/376918/number-of-home-structure-fires-in-the-us/

http://www.city-data.com/city/South-Carolina.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.