There's a sense of freedom that comes with owning a car. Maybe it's because you can take to the open road whenever your heart desires. However, South Carolina car insurance can be costly, putting a crimp in your style if you're unsure how to lower your rates.

Fortunately, a South Carolina independent insurance agent can help with custom quotes through highly rated carriers. They work with dozens of markets, giving you options on coverage and price. Get connected with a local expert to begin saving today.

What Is Car Insurance?

In South Carolina, you'll be mandated by state law to carry the minimum liability limits to use the roadways. Check out what's necessary below and how car insurance works:

- Minimum limits of auto liability in South Carolina: $25,000 per person/ $50,000 per accident/ $25,000 property damage

- Property: Coverage for damage to vehicles and outside property

- Liability: Coverage for bodily injury or property damage

- Medical: Coverage for your medical expenses due to an at-fault loss

How Much Is Car Insurance in South Carolina?

The average annual price of car insurance in South Carolina is $1,210. Carriers use numerous risk factors when rating your car policy, making coverage different for everyone. Insurance companies look at the following items when calculating your costs:

- Loss history

- Driving record

- Value of vehicle

- Location

- Experience level and age

- Coverage selection

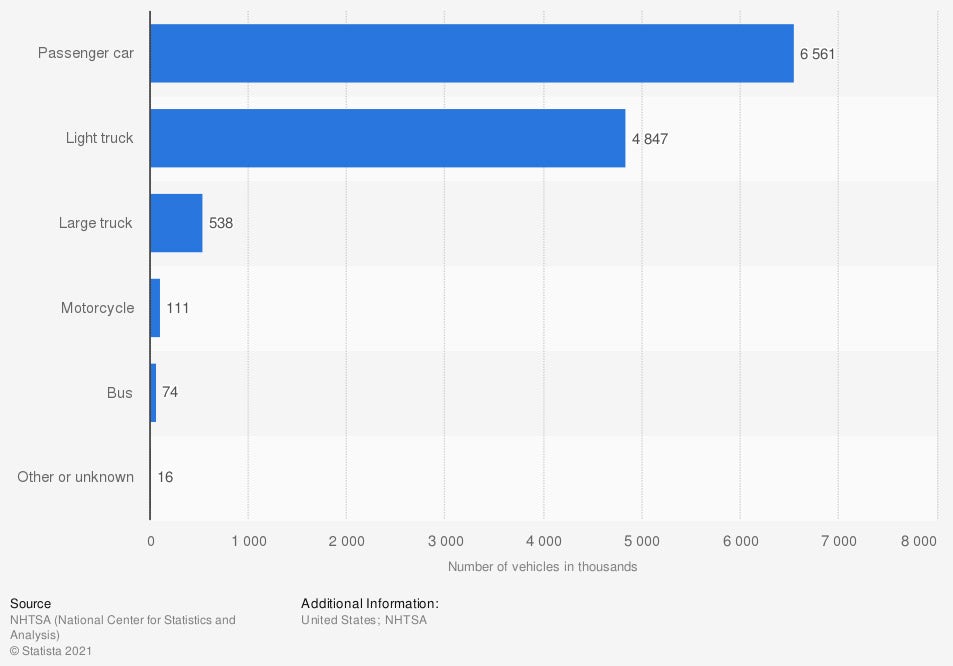

Number of vehicles involved in traffic crashes in the US

The number of car accidents that occur in the US is high. It's best to be as prepared as possible, so you're not paying out of pocket.

How Much Is Full Coverage Car Insurance in South Carolina?

You won't know your actual car insurance premium until you obtain professional quotes. The national annual average cost of car insurance is $1,311, giving you an idea of what it could be. Full coverage is vital when you want complete protection.

Check out your full coverage car insurance options:

- Gap coverage: Pays for the difference between your remaining loan balance and the market value when a total loss occurs.

- Tow coverage: Will pay for a tow truck to tow a covered auto due to a loss.

- Rental car coverage: Will provide reimbursement for a rental car when your covered auto is damaged.

- Comprehensive coverage: Will pay for property damage to your vehicle that is hit by an unavoidable obstruction.

- Collision coverage: Pays for property damage to your car in the event of a crash.

How to Lower Car Insurance Rates in South Carolina

When it comes to lowering your car insurance rates, there are a variety of things you can do to help. First, getting a licensed adviser that can shop multiple markets is key, and will save some time. Take a look at items that help reduce South Carolina car insurance premiums below:

- Have a good driving record

- Pick a vehicle with high safety ratings

- Stay with the same carrier for at least three years

- Include all household automobiles for a multiple vehicle discount

- Take driver's training courses for a discount of 10% or more

Will My Safe Driving Record Impact My Car Insurance Rates in South Carolina?

Every carrier will use your motor vehicle records when determining your insurance costs. The safer you are when driving, the less expensive your premiums will be.

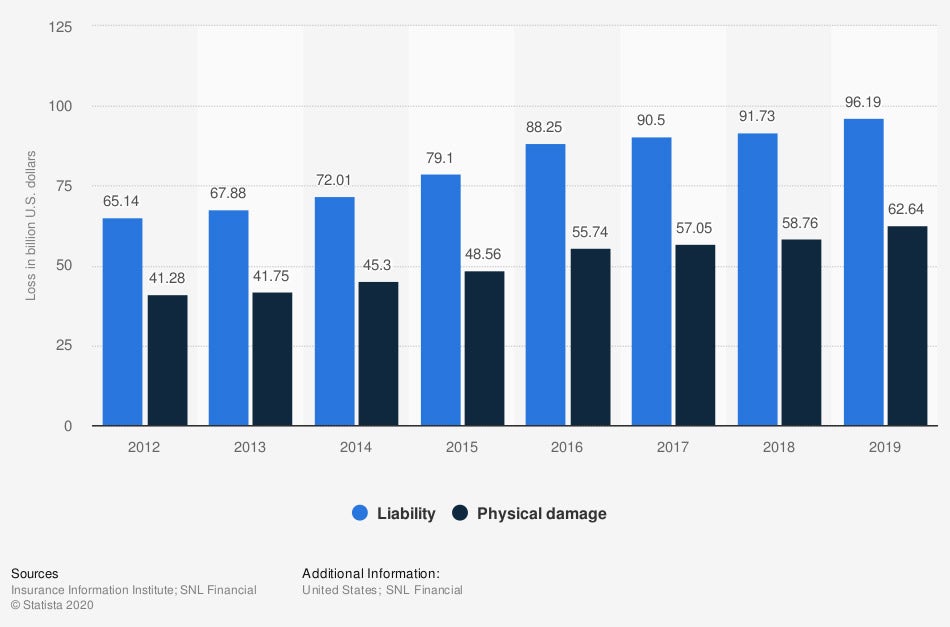

Incurred losses for private passenger auto insurance in the US, by type

Accidents will go on your driving record and follow you around like a credit score. The more accidents you have, the worse your pricing will be with the insurance companies.

How a South Carolina Independent Insurance Agent Can Help

South Carolina car insurance doesn't have to cost an arm and a leg. There are several carriers on the market that can help keep your premiums low. If you know where to look, you'll get sufficient coverage for a fair price.

A South Carolina independent insurance agent shops through multiple carriers at once, saving you time and money. They'll find a competitive option that doesn't compromise on protection. Connect with a local expert on trustedchoice.com to start saving today.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/192097/number-of-vehicles-involved-in-traffic-crashes-in-the-us/

https://www.statista.com/statistics/428991/incurred-losses-for-private-auto-insurance-usa-by-type/

http://www.city-data.com/city/South-Carolina.html