South Carolina ranks 11th nationwide when it comes to lightning fatalities. This means the state is no stranger to this natural phenomenon, so it's best to be prepared on how to file a claim through your South Carolina homeowners Insurance policy should lightning strike you, your home, or your vehicle.

Fortunately, a South Carolina independent insurance agent is well versed on the weather patterns of the state and what to do when you need to file a claim. They'll be there to walk you through the process, but it's always a good idea to understand the necessary steps you'll need to take if lightning strikes.

Why you may want to consider lightning coverage in South Carolina

- Lightning strikes occur in the US 25 million times a year.

- Lightning kills 20 or more people in the US every year.

- Lightning can reach 50,000 degrees Farenheit.

- Lightning can travel 10 to 12 miles from a thunderstorm.

How Do I File a Claim for Lightning Damage in South Carolina?

In the unfortunate event that lightning damages your property, you'll most likely want to reach out to your insurance company and file a claim. However, before you do that, you'll want to make sure that the damage is significant enough to file a claim. Keep in mind that you'll need to pay your deductible, so the damage should be more than that to make filing a claim worth it. Once you've decided that you need to file a claim, you can follow these steps.

- Assess the damage: When it is safe to do so, it's important to assess the damage done to your property. Not only will this help you determine if you need to file a claim, but it's also an ideal time to document all the damage. When you call the insurance company they'll ask what was damaged, so take full account of all items. If possible take photos, videos, and write down everything you can.

- File your claim: It's time to file your claim, and you do so by calling your insurance company. You'll explain what happened and they'll provide you with a series of next steps. They'll also send out an adjuster to assess the damage. It's important not to touch or move anything that was damaged by lightning until after the claims adjuster has been to your property.

- Decide if you want to go through with the claim: Before you move forward with your claim, you'll have the option to decide whether it's worth paying your deductible. Your insurance company will provide you with their assessment of the damage and allow you to decide. If your deductible is $5,000 and the damage is only $1,000, it would not make sense to move forward with the claim.

- Fill out any necessary paperwork and wait for the next steps: Your insurance company will walk you through the next steps of your claim and provide you with any paperwork that might need to be filled out. Make sure you fill out all paperwork promptly, as most insurance companies have a time frame that lightning claims must be completed within.

- Receive payment: Once the paperwork and assessment are squared away, you wait for the insurance company to provide you with payment to repair damages.

What to Do before and after Lightning Strikes a Home in South Carolina

If you're going to be involved in a lightning storm, hopefully, you'll have some warning. Even if your home is hit unexpectedly, there are few things you can do before and after your home is hit to make sure you're safe and protect your home from further damage

- Unplug electrical devices: If lightning just struck your house, do not touch any devices that are still plugged in, this could result in you electrocuting yourself. If you hear lightning and it has not struck your house, you can go through your home and unplug all electrical devices.

- Avoid faucets and fixtures with running water: Electricity can travel through pipes and you could get electrocuted by touching these items.

- Avoid concrete walls and floors: Electricity can travel through metal wiring found in concrete flooring and walls.

- Check for fires: Lightning strikes often result in fires. If your home is hit and you suspect a fire, call the fire department immediately.

- Watch for debris: Be cautious of any falling debris from chimneys, shingles or walls that may have been damaged by the lightning strike.

- Contact an electrician: It's a good idea to call in an electrician to check all of your electrical outlets after a strike.

- Do not stay in the home if it's unsafe: If you're unsure of what damage was caused by the lightning strike, it's best to leave the home and return when it's been properly inspected.

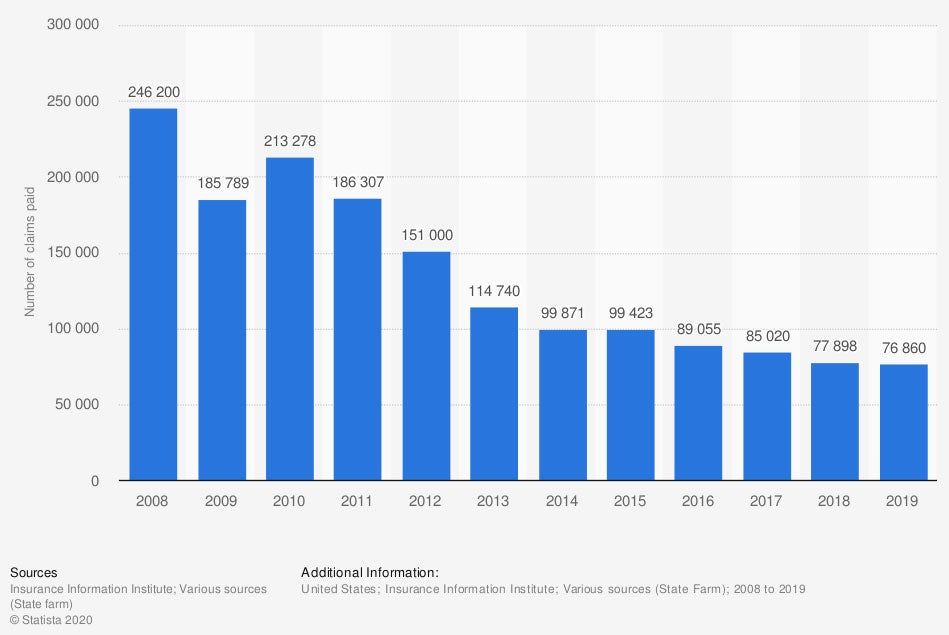

Number of homeowner insurance claims paid due to lightning losses in the United States from 2008 to 2019

In 2019, there were 76,860 insurance claims paid due to lightning losses in the United States.

What Do You Do If Lightning in South Carolina Strikes Your Car?

The most important thing to remember if you're driving in your car during a lightning storm is that it's safer to stay in your car than to get out of your car. If you're already in your vehicle during a lightning storm, it's best to pull over and turn it off. Sit with your hands in your lap and avoid touching any of your car's dials. However, cars are made of metal and the metal surrounding the car will protect you if you're struck. With that said, your vehicle could still sustain serious damage, so as soon as the lightning storm is over, it's best to get out of your vehicle and make sure there are no risks of fire or other damage.

Does Fire Insurance Cover Lightning in South Carolina?

Lightning and fires that are caused by lightning are covered under your homeowners policy. Lightning damage can affect the inside and outside of your home, your possessions, and even you. Fortunately, all of this falls under your standard homeowners policy. The protection will also extend to your personal property like electronics, furnishings, and other personal possessions, living expenses if you temporarily need to move out of your home, and other structures on your property like garages and sheds.

Unfortunately, lightning and fires tend to go hand in hand. Every year there are thousands of lightning fires across the US. On average, firefighters respond to more than 20,000 fires that are started by lightning per year. These fires cause hundreds of millions of dollars in property damage across the US. Of the lightning fires that do occur, 19% are in homes.

Why Should I Work with a South Carolina Independent Agent?

Filing an insurance claim can be a stressful event. There are a variety of steps to take and things you can do to make the process smoother. If you've never filed a claim it can be overwhelming. South Carolina independent insurance agents have helped file hundreds, if not thousands, of claims and know the process and the steps to take. They can help you understand the process and make the claim as stress-free as possible. They can also help you understand what happens to your insurance after you file a claim and help you adjust your policy if needed.

Article Reviewed by | Paul Martin

https://stormhighway.com/what_happens_when_lightning_strikes_a_house.php

https://www.weather.gov/safety/lightning-cars

https://www.nfpa.org/-/media/Files/News-and-Research/Fire-statistics-and-reports/US-Fire-Problem/Fire-causes/oslightning.ashx?la=en#:~:text=22%2C600%20lightning%20fires%2C%20on%20average,local%20fire%20departments%20per%20year.&text=22%2C600%20fires%20per-,year%20that%20were%20started%20by%20lightning.,direct%20property%20damage%20per%20year.

graphic. source: https://www.weather.gov/safety/lightning

© 2024, Consumer Agent Portal, LLC. All rights reserved.