Sometimes roofing contractors have your best interests at heart, but sometimes they're really just scammers out to get your money. Since you can't always immediately know for sure which kind just knocked at your door, it's imperative to become familiar with the red flags for roofing insurance scams. Start with our guide to protecting yourself from roofing insurance scams in South Carolina.

What Is Roofing Insurance Fraud in South Carolina?

In South Carolina, roofing insurance fraud operates much the same as it does in other states. A shady contractor can either purposefully damage your roof or greatly exaggerate their estimate and charges just to get money from your South Carolina homeowners insurance. After they've done their damage financially, these scammers don't even finish the repairs to your roof, or they do a poor job, if they even start.

Does South Carolina Have Laws to Protect Homeowners from Roofing Scams?

Fortunately for homeowners in South Carolina, the state passed a law in 2013 to protect them against roofing insurance scams. Under the state's law, those who have signed a contract with a roofing contractor have the right to cancel within five days of being told their job won't be covered at all or in part by their insurance company. The law also prohibits down payments until after the five-day window passes and disallows the alleged contractor from filing insurance claims for the homeowner.

Does South Carolina Homeowners Insurance Cover Roof Damage and Repair?

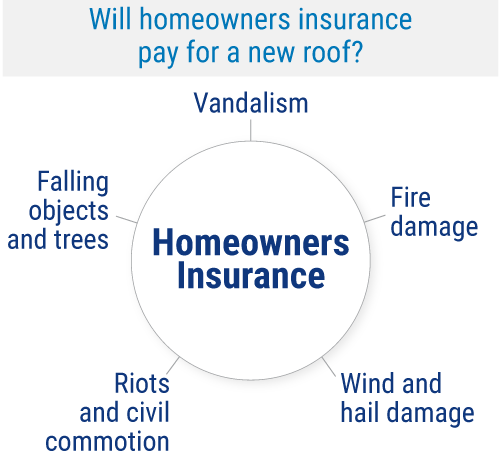

Yes, in many instances your South Carolina homeowners insurance will reimburse you for damaged or destroyed roofs. That's why the safest bet, if you need to repair or replace your roof, is to always file a claim through your insurance yourself. Your South Carolina homeowners insurance reimburses for roof repairs/replacement caused by the following:

When you file a claim for roof damage through your home insurance, you'll have to first pay your deductible amount out of pocket. One way roofing scammers get you is by promising that you won't have to pay a deductible, and that all costs will be covered by your insurance. This is fraud and deceit, and will only lead to unexpected costs and headaches on your end.

The Most Common Types of Roofing Insurance Scams in South Carolina

There are many types of roofing insurance scams happening nationwide, especially recently. But learning the most common types of scams in your state can help you prepare in advance so you can avoid them. Here are the most common roofing insurance scams in South Carolina:

- Storm chasers: Some scammers like to visit your city after a huge storm has just passed, and claim that it's critical to inspect your roof for resulting damage right away. The scammer has no intention of completing the job correctly. They only want your money.

- Lowball offers: Some scammers will charm you with an offer for repairs that seems too good to be true. In this case, that's because it is. This scammer will either take your money and run, or up-charge you partway through the project.

- Exaggerated claims: Some scammers will get started on your roof for the price you agreed to, but then halfway through, they'll tell you they need more money for extra materials or that they found extensive damage. The scammer may have even caused damage themselves, just to get more compensation.

- Unfinished/inadequate repairs: Some scammers like to charm you out of your money and then seemingly disappear off the face of the Earth. Others will actually pretend to do the job, but they'll either leave it unfinished or do very poor quality work.

Watch out for these frequent roofing insurance scams in South Carolina. When accepting an offer for roof repairs to your home, always take the extra time to do your research beforehand.

Common Natural Causes of Roof Damage in South Carolina

South Carolina is prone to hurricanes and tropical storms. Storm chasing scammers like to hit up your town after a hurricane has passed, and take advantage of vulnerable and upset homeowners by claiming their roofs could be severely damaged. Make sure to do your research ahead of time so you can avoid these scams, and also ask a South Carolina independent insurance agent to get you set up with the right home insurance to properly protect your roof.

How Else Do Roofing Scams End up Costing You?

Roofing scams can cost you big, in more ways than one. Some scammers can get you to hand over tens of thousands of dollars. For example, one roofing scam in Florida demanded $12,000 for repair costs and told the homeowner that their insurance company would've normally have charged $35,000 for the project.

While you can lose a huge chunk of money, you can also be set back in terms of stress, energy, and time. You could also be in trouble with your homeowners insurance if you appear to have filed an illegitimate roof damage claim. Make sure to never let anyone else file claims through your insurance for you, unless it's your South Carolina independent insurance agent.

Best Ways to Protect Yourself from Roofing Scams in South Carolina

Before you accept any contractor's offer to work on your roof, put them to the test by asking for credentials and other important information up front. Start with this handful of critical questions to ask your roofing contractor:

- Do you have references? Ask your contractor for a list of references as well as past completed projects.

- Do you have proof of insurance? Ask your contractor for proof of contractors liability insurance and workers' comp before you ever sign a contract.

- Can I have a written proposal? Ask your contractor for a written proposal so you can review the project details like payment scheduling, timeline, and overall description.

- Are you licensed/bonded? Ask your contractor for proof that they are properly licensed or bonded by the state to work.

- What's your place of business? Ask your contractor what business they represent and get all of their contact information, as well as a tax ID number and a copy of their business license.

- Can I have a roofing warranty? Ask your contractor for a roofing warranty and review the details carefully for any loopholes.

Beyond asking these important questions, it's also a good practice to do your research online before hiring a contractor to work on your roof. Websites like the Better Business Bureau's provide evidence of customer complaints and potential scams if you search for a business or contractor by name. It's worth the extra effort to do a quick check.

Why Choose a South Carolina Independent Insurance Agent?

It’s simple. South Carolina independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut the jargon and clarify the fine print so you know exactly what you’re getting.

South Carolina independent insurance agents also have access to multiple insurance companies, ultimately finding you the best homeowners insurance coverage, accessibility, and competitive pricing while working for you.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

scinsurance.net/news-room/view/new-law-protects-homeowners-against-roofing-scams

forbes.com/advisor/homeowners-insurance/roof-repair-scams/#:~:text=Roof%20repair%20scams%20are%20often,with%20unfinished%20or%20shoddy%20work.

fox4now.com/news/local-news/contractors-promising-a-new-roof-taking-your-rights-and-money-instead

© 2024, Consumer Agent Portal, LLC. All rights reserved.