Of the top six deadliest hurricanes ever to make landfall in the US, two have struck South Carolina. With all the stress that these intense storms bring, it can be hard to determine what you're supposed to do right after one passes. It's important to first know how your coverage protects you and if you've got enough.

A South Carolina independent insurance agent can help you get covered with all the homeowners insurance and other policies you may need to guard against hurricane damage. They'll help you get the right protection long before hurricane season. But first, here's a guide to what to do right after a hurricane.

Find Safety: the First Step after a Hurricane

After a hurricane passes, the top priority is to get yourself and your family to safety. Find shelter if you haven't already, and if the power's out, use blankets to keep warm. You might also want to reach out to family members who don't live with you to let them know you're safe.

If you weren't at home when the storm hit and return to find property damage, wait until an inspector has had a chance to look around before you enter. If the damage is extensive, it might not be safe to go into your home until after repairs have been made. Make arrangements to stay with other family members or friends, at a hotel, or at a South Carolina emergency shelter.

How Often Do Hurricanes Hit South Carolina?

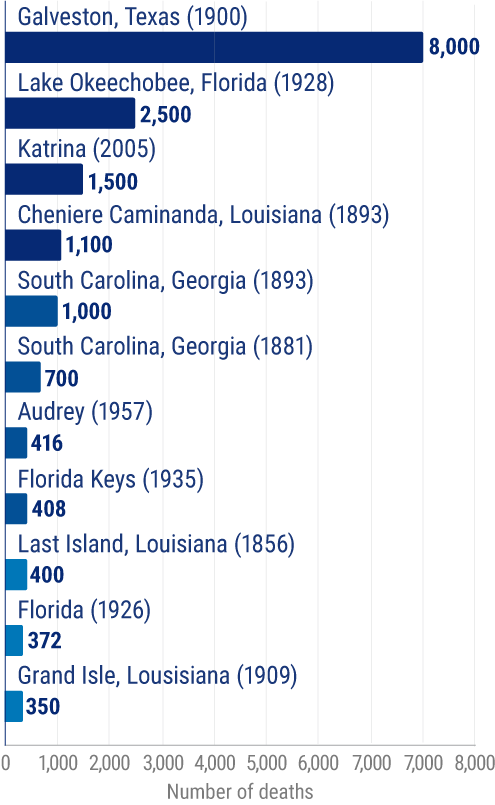

South Carolina has seen 43 hurricanes make landfall since the mid-nineteenth century. Hurricanes in South Carolina can be devastating and deadly. Just check out the chart below and see for yourself.

The deadliest tropical cyclones and hurricanes on the US mainland from 1851 to 2020

One-third, or two of the top six most deadly hurricanes to affect the US mainland since 1851, have impacted South Carolina.

Knowing just how destructive the hurricanes that hit South Carolina can be can further stress the importance of ensuring that your home is protected with the right homeowners insurance coverage.

After Finding Safety, What Do You Do after a Hurricane?

You've secured your family's safety and your own, and now it's time to move on to other necessary business after the hurricane is over. Follow the steps below to get yourself rolling.

The five most important steps to take after a hurricane:

- Get safety-oriented repairs done: Sometimes the safety of your family is compromised until certain repairs are made to your property, and you can't wait for your insurance company to respond. Go ahead and make these necessary repairs, but remember to save your receipts to submit later.

- Note any damage: It's time to inspect your home's entire perimeter and contents for damage or loss from the hurricane. Compare what you see now to your existing personal inventory to confirm if you're missing any property.

- Schedule property inspections: Your insurance company will want to schedule a visit from an adjuster to assess your home's damage in person. Next, you’ll want to get professional estimates for repairs from a licensed contractor. Sending these estimates to your insurer can speed up the claims process.

- Copy important documents: Make copies of any receipts, property estimates, and personal inventory lists. You'll have to give a lot of information and documentation to your insurer, but it's important to keep copies for yourself to have on record, too.

- File a claim: Next, you’ll want to talk to your South Carolina independent insurance agent, who can help you file a claim immediately and walk you through the rest of the journey. They'll keep you updated throughout the process and provide you with an estimated timeline of reimbursement.

After ensuring the safety of all your home's inhabitants, you can move on to these steps to take care of the home itself. Remember that your South Carolina independent insurance agent is standing by to help you as much as they can with the claims process and getting you the reimbursement you're entitled to.

How to File a Hurricane Damage Claim

Especially if you've never had to file an insurance claim before, it might seem like a daunting process after a major incident like a hurricane. But following the steps below can help make the process much simpler.

Here's how to file a hurricane damage claim through insurance:

- Call your insurance agent immediately: Your South Carolina independent insurance agent can actually contact your insurance company for you and get the claims process rolling.

- Get claims forms: Next, your insurance company will send claims forms for you to note your property damage, which you'll want to complete and send back as soon as you can.

- Schedule a home inspection: You'll probably be required to schedule a home visit with an insurance adjuster to assess your home's damage in person, so try to do that ASAP.

- Present receipts: If you've had to stay at a hotel, have incurred other extra expenses, or made temporary repairs to your home since the hurricane, send all of these receipts to your insurance company.

- Get reimbursed: Your South Carolina independent insurance agent will keep you informed throughout the claims process, including on when you can expect your reimbursement.

A hurricane can rattle you in more ways than one, which is what makes lists like these helpful to have as a reference when needed.

Am I Still Protected If I Don’t Have Hurricane Insurance?

You might have heard the term hurricane insurance before, but truthfully there are several coverages that can protect you from these storms, like:

- Homeowners insurance: Unless you live in a zone where coverage from windstorms is excluded, your home insurance protects your home's structure and its contents from high wind damage.

- Windstorm insurance: Those who live in areas prone to hurricanes may be required to get additional windstorm coverage on top of their regular home insurance to guard their property from high wind.

- Flood insurance: Since home insurance excludes damage caused by natural floodwaters, you'll need to have a flood insurance policy to protect yourself from the water damage that can accompany a hurricane.

- Car insurance: Folks who have comprehensive, or other-than-collision car insurance can rest assured that their vehicles will be protected against hurricane damage.

If you're unsure of whether your coverage is adequate to stand up against a hurricane, speak with your South Carolina independent insurance agent.

What Exactly Does Hurricane Insurance Cover?

The combination of coverage from your homeowners policy and windstorm insurance can guard you from hurricanes in the following ways:

- Protecting your dwelling: Your home's structure or dwelling is protected by either your home insurance or windstorm insurance against the high wind that hurricanes bring.

- Protecting your contents: Your personal property like books, silverware, and more, is also protected by these policies against damage or loss caused by hurricane wind.

- Offering additional expenses reimbursement: If you have to stay at a hotel while your home is being repaired for hurricane damage, your home insurance can reimburse you for these extra costs.

Your insurance can help you get your life back on track after a severe natural disaster like a hurricane. That's why you'll want to make sure you're covered in advance.

Tips to Keep You Safe after a Hurricane

There are still more concerns to keep in mind after a hurricane passes. Follow these important tips to stay safe after a hurricane:

- Drive carefully: If you must drive after a hurricane, never attempt to drive through puddles, and avoid bridges as much as possible.

- Stay clean and sanitized: Make sure to wash yourself and sanitize your hands ASAP after a hurricane, especially if you've come into contact with water.

- Avoid standing water: There might be snakes or other critters lurking in standing water, which is why you should never attempt to wade through it.

- Wait for inspections: Don't try to enter a building after a hurricane until it's been inspected by a professional and determined to be safe for reentry.

- Avoid electric shocks: Steer clear of downed power lines or appliances that have been touched by water until they've been inspected.

Staying safe before and after a hurricane can be much easier if you're prepared. It all starts with a proper awareness of your insurance coverage. If you haven't yet, take some time to get in touch with your South Carolina independent insurance agent to ensure you're ready, coverage-wise, for hurricane season.

Why Choose a South Carolina Independent Insurance Agent?

South Carolina independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut the jargon and clarify the fine print so you know exactly what you’re getting.

South Carolina independent insurance agents also have access to multiple insurance companies, ultimately finding you the best home insurance coverage, accessibility, and competitive pricing while working for you.

Author | Chris Lacagnina

https://www.cdc.gov/disasters/hurricanes/be-safe-after.html

© 2025, Consumer Agent Portal, LLC. All rights reserved.