As a caterer, you have more to worry about than just cooking delicious meals for celebrations. You're responsible for keeping up with guest food allergies, food spoilage, and employee health, as well as injuries and property damage. Every day your catering company is at risk of losses due to numerous events, and South Carolina small business insurance is there to make sure you can keep your burners turned on.

Fortunately, having a South Carolina independent insurance agent in your corner makes purchasing catering company insurance an easy process. They can help you build a comprehensive policy that protects your business no matter where you are. To start, let's talk about the types of coverage available for catering companies in South Carolina.

What Is South Carolina Catering Company Insurance?

Catering company insurance is a specific type of business insurance that is designed to protect catering companies from the unique risks they may face. Policies usually include general liability, commercial property, commercial auto, and business interruption insurance. However, many catering companies will opt to add additional coverages to protect against risks like food contamination, equipment breakdown, and transportation coverage.

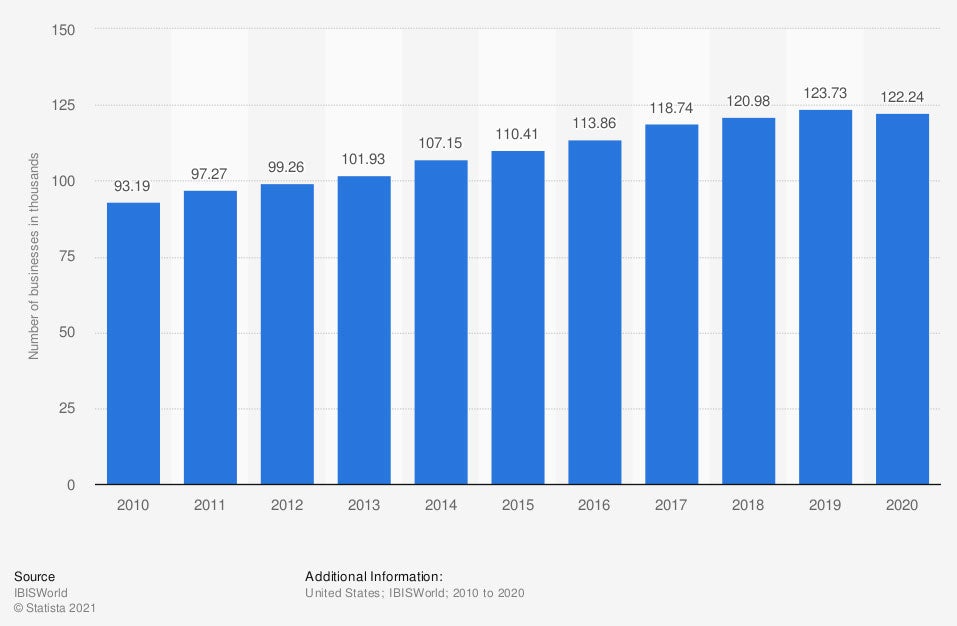

Number of businesses in the catering sector in the United States from 2010 to 2020 (in thousands)

In 2020, there were more than 122,000 catering businesses in the US.

How to Insure a Catering Company in South Carolina

The first step to insuring your catering company is to assess your risks. Every business is different. A private caterer run out of a home will need different insurance than a large catering company run out of a banquet hall or commercial kitchen. Once you understand your risks, you can start shopping around for coverage. Working with a South Carolina independent insurance agent can help you understand the different risks your business faces and they'll take care of the insurance carrier shopping for you. You'll then be able to sit down with your agent to go over different pricing options and coverages and determine which policies fit your business. Once you've purchased your insurance, it's a good idea to reassess your policy each year to make sure it's still meeting your needs.

What Does Catering Insurance Cover in South Carolina?

According to insurance expert Jeffrey Green, coverage for catering companies should include general liability, commercial property, commercial auto, and business interruption insurance. In addition to these, you'll most likely need add-on coverages to protect your food and employees. The following policies offer a variety of coverages for your catering business.

- General liability: Pays for medical bills, legal fees, and other costs associated with a patron filing a lawsuit against your catering company. If a patron experiences an injury or property damage, general liability helps pay the costs.

- Commercial property insurance: Pays to repair or replace any damage that your business property sustains if you own the building. It will also cover the contents inside your building.

- Commercial auto: Covers any company vehicles that are used for business operations. Commercial auto will cover accidents as well as theft and damage to your vehicle or the contents in your vehicle.

- Business interruption: If your catering company has to temporary close its doors due to an unforeseen event, business interruption helps cover payroll and other expenses until you can reopen.

- Liquor liability: If you serve liquor, this insurance provides protection against accusations of overserving that lead to injury or damage.

- Food spoilage: This add-on policy covers food spoilage as a result of power outages or mechanical failures. For catering companies that store large amounts of food in freezers or refrigerators, food spoilage coverage is crucial.

- Equipment breakdown coverage: Provides coverage if your equipment has a mechanical breakdown or stops working for unknown reasons.

- Inland marine insurance: Covers any damage that your inventory sustains while in storage as well as your goods and equipment when they are on-site or being transported.

- Worker's compensation: Helps pay for injuries, medical bills, and lost wages for employees if they're injured while on the job.

What Doesn't Catering Company Insurance Cover in South Carolina?

Catering company insurance will not cover any damage that your business or inventory sustains as a result of flooding or tornadoes. Both of these policies are purchased separately from your standard business policies. Your policies also will not cover any damage or food spoilage as a result of poor maintenance or carelessness.

What Are the Benefits of South Carolina Catering Company Insurance?

Catering companies are expected to deliver high-quality dining and party experiences for small and large groups of people. Many moving pieces and lots of employees usually go into creating a memorable experience for your clients. When you're traveling with food and cooking in different environments, you, your business, and your employees face risks of injury, spoilage, damage, or losses from unforeseen events. Catering company insurance protects you when risks threaten your business. With the proper insurance, you can focus on your business and not worry about what will happen to your company if you're faced with an unfortunate situation.

How Much Does Catering Company Insurance Cost in South Carolina?

Many factors go into determining the cost of any business insurance policy. "The insurance company will consider the type of catering business, number of locations, the number of employees, and how long the company has been in business when they underwrite the risk," explained Green. This makes it nearly impossible to put a specific price on insurance policies. Your independent agent can provide you with a more specific quote for what premium costs your catering company can expect.

Why Should I Use an Independent Insurance Agent in South Carolina?

South Carolina independent insurance agents are experts in catering company insurance. They understand different coverage options and can help you determine which combination of policies your business will need. They also take care of quote shopping for you. They'll call multiple carriers to line up different quotes and present you with the best options. Should your business ever need to file a claim, your South Carolina independent insurance agent will be there to help you through the process.

Article Reviewed by | Jeffery Green

Iii.org

statista.com

https://insuremyfood.com/catering-insurance/

© 2024, Consumer Agent Portal, LLC. All rights reserved.