Farm equipment includes some of the most valuable assets that you have on your farm. They also don't come with a cheap price tag. Anything that costs your business money, and is used to keep your business running, deserves proper protection. Farm equipment insurance protects your equipment so you can continue to run your farm. A South Carolina independent insurance agent knows the ins and outs of this addition to South Carolina farm insurance, and can help you find a policy that fits your needs. To start, let's learn more about this coverage.

What Does Farm Equipment Insurance Cover in South Carolina?

Farm equipment comes in many shapes, sizes, and costs. For most policies, the following equipment will be covered against perils that are outlined in the policy.

- Farm equipment and tools

- Tractors and wagons

- Combines

- Forage harvesters

- Heating and cooling systems

- Boilers, pressure vessels, and water heaters

Not every farm equipment policy will cover each of these types of equipment, so it's important to work with your independent insurance agent to get a full assessment of your equipment and how to get it properly covered.

What If I Only Want to Cover Certain Items on My South Carolina Farm?

When selecting a farm equipment policy, you'll have the option to pick a policy that is all-encompassing foryour machinery and equipment, or the ability to insure individual items. This is called blanket coverage and scheduled coverage.

- Blanket coverage: Under a blanket coverage policy, all of your machinery and equipment would fall under one policy limit.

- Scheduled coverage: Scheduled coverage provides the ability to pick and choose which equipment you want to be covered and for how much. You can customize your limits and your terms.

Both policies have advantages and disadvantages, and some insurance companies may provide a discount or other benefit for selecting blanket coverage. However, scheduled coverage provides more flexibility in covering a variety of equipment you may have.

When Does Farm Equipment Insurance in South Carolina Apply?

Farm equipment insurance is designed to help you repair or replace your equipment if it is damaged or destroyed due to a number of covered perils. Depending on your policy, it should typically provide coverage for the following.

- Fire

- Theft or vandalism

- Falling objects

- Disasters

- Cab glass breakage

- Overturn of vehicles due to collision

- Collapse

If you're unsure whether a certain event would be covered under your farm equipment policy, you can ask your independent agent to check your policy.

What Are the Most Common Types of South Carolina Farm Equipment to Cover?

The most common types of farm equipment goes hand in hand with the most common type of equipment that is insured by farm equipment insurance.

- Tractors: Tractors are by far the most common piece of farming equipment. With their ability to plow, plant, cultivate, fertilize, harvest, haul materials, and provide personal transportation, they're versatile pieces of equipment used on nearly every farm.

- Balers: Hay balers take a cut and raked crop and compress it into compact bales that make it much easier to handle, transport and store. When's the last time you saw a farm without some hay bales? Balers are another highly common piece of farming equipment.

- Combines: South Carolina is home to corn, wheat, oats, and a variety of other grain crops, and a combine is used to harvest these crops. It combines reaping, threshing, gathering, and winnowing into a single process.

- Plows: Before you sow or plant seed you need to loosen and turn the soil. Plows are the machinery that gets this done.

- Mowers: Not your typical lawnmower, in agriculture a mower harvests grass and forages crops. It has the ability to cut standing vegetation and make it into hay.

- Forage harvesters: This machinery harvests forage plants in order to make silage. Silage is grass, corn, or hay that has been chopped into small pieces and then compacted together to be stored.

While these are the most common types of machinery insured in South Carolina, the cost of a tractor will vary greatly from that of a forage harvester. Your insurance costs will follow your machinery, so if you have a farm full of very expensive machinery you can expect to pay higher premiums.

How Much Does Farm Equipment Coverage in South Carolina Cost?

It's difficult to put a solid number on farm equipment coverage because it can vary greatly between equipment and farms. Plus, your premium will depend on whether you choose blanket coverage or scheduled coverage. Your costs will also be affected by your location. Farms that are located near the South Carolina coast are more likely to receive damage from hurricanes and flooding. Your independent insurance agent can help you gain an idea of what the costs to insure your farm equipment might be.

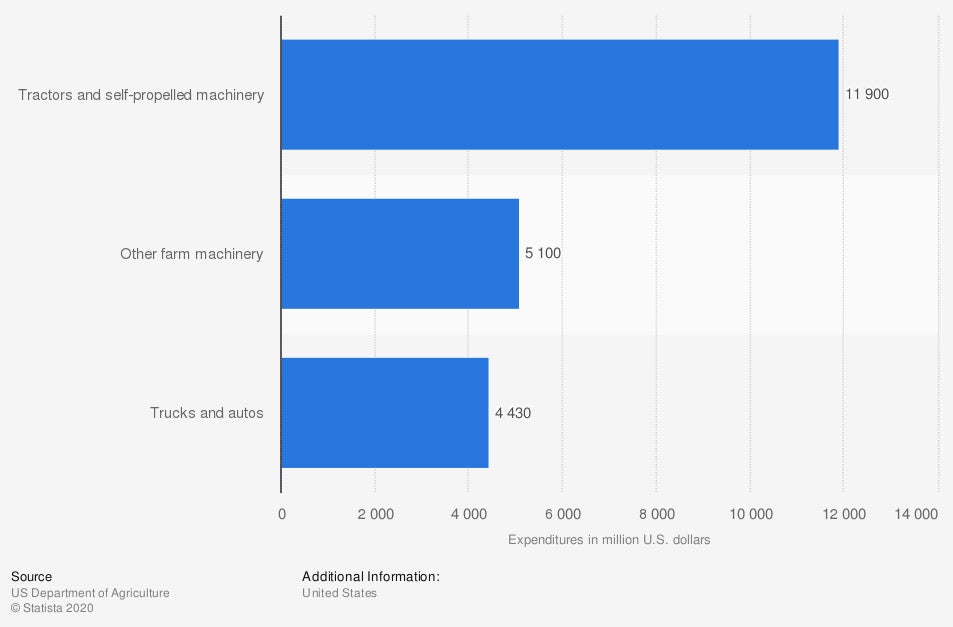

Farm production expenditures on machinery by US farms in 2019, by type

(in million US dollars)

In 2019, US farms spent $11.9 billion on tractors and self-propelled farm machinery.

What Are Common Equipment Insurance Claims in South Carolina?

When you're running a business on thousands of acres of land that include people, animals, and machinery, there are many things that can go wrong. In South Carolina, farmers also run the risks of damage that can come from weather-related events. The state is prone to hurricanes, tornadoes, and severe winter weather and rainstorms. All of these events directly correlate with the most common equipment insurance claims.

- Motor vehicle accidents

- Equipment breakdown

- Glass breakage

- Wind damage

- Hail or lightning damage

- Fire damage or loss

It's important to understand your risk for certain weather-related events before purchasing your farm equipment insurance. If your farm is at high risk of flooding or tornadoes, you'll want to make sure to have adequate coverage for your equipment in case it is damaged or destroyed during a weather event.

How Can an Independent South Carolina Insurance Agent Help?

Farm equipment is one of the biggest investments that farmers can make, and you want your investment to be protected. A South Carolina independent insurance agent understands farms and the equipment needed to successfully run them in South Carolina. They understand the different options for farm equipment insurance and can shop quotes and companies to find you a good rate. They can also advise on which equipment to insure and how much insurance to purchase.

Article Reviewed by | Paul Martin

https://www.wesmckenna.com/commercial-products/farm-insurance/farm-equipment-insurance

https://www.mylsb.com/webres/pdf/EBFarmFAQ.pdf

https://www.insurancejournal.com/news/national/2018/05/16/489378.htm

© 2024, Consumer Agent Portal, LLC. All rights reserved.