South Carolina is a state filled with flood zones, so the last thing you want to do is skimp on your flood insurance. It's a common misconception that flood insurance is unaffordable and not necessary, but neither could be more false for South Carolina residents.

Fortunately, South Carolina independent insurance agents are experts in flood insurance in the state. They've helped thousands of families get protection from the variety of threats that residents face from the numerous natural disasters that sweep through the state every year. Before you find your agent, let's talk about how flood insurance is calculated.

What Is the Average Cost of Flood Insurance in South Carolina?

It's a common misconception that flood insurance is very costly. However, this is often not the case, and South Carolina is no different. Unfortunately, there's no specific number for how much South Carolina flood insurance costs, because rates vary depending on several factors.

- Location

- Property value

- Risk

- Value of your home

- Value of your belongings

- The type of coverage being purchased (contents or building coverage)

- The age of your home

- The structure of your home

All of these help insurance companies determine the likelihood that your home will be damaged by flooding. Based on this list, your policy premium will be built. Every home will be different, but on average, most homeowners can expect to pay between $500 and $700 a year for flood damage insurance.

How Is Flood Insurance Calculated in South Carolina?

Flood insurance is calculated by considering the factors listed above, in addition to the elevation of your home and where it's located. Nearly all of South Carolina is in a flood risk zone, but some areas are higher risk than others. If your home is located in a low-to-moderate risk area you could get lower rates through the Preferred Risk Policy (PRP). The PRP offers low-cost coverage to owners and tenants who live in flood zones B, C, and X in the National Flood Insurance Program (NFIP) Regular Program communities. Your independent insurance agent can help you discover what type of flood zone your South Carolina home is in.

Another factor that is used to calculate flood insurance is whether you have a basement and whether you choose contents and building coverage or just one of these coverages.

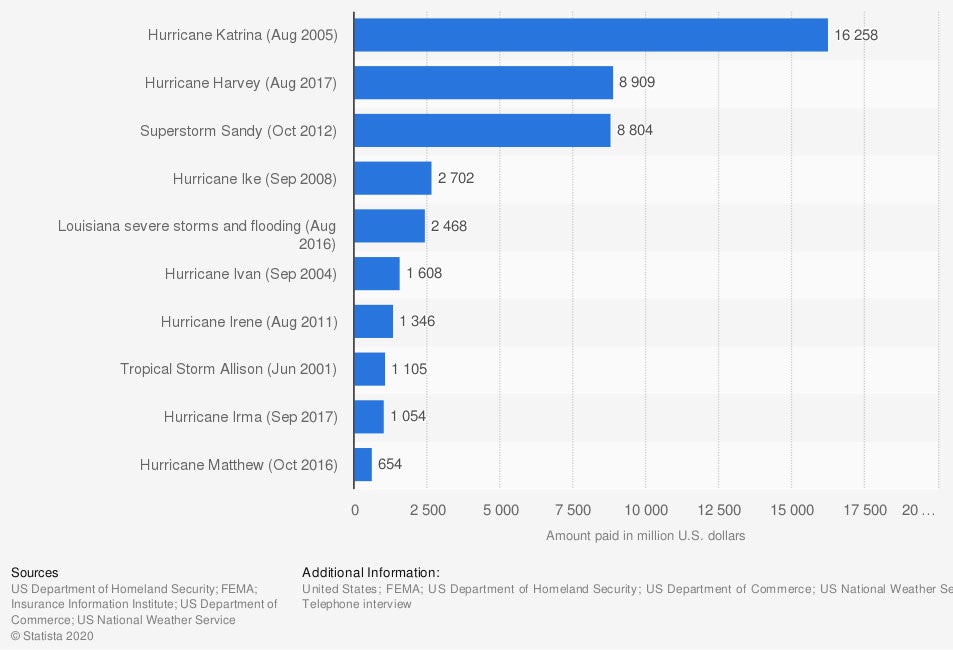

Most expensive flood disasters in the United States from 1978 to 2019, by National Flood Insurance Program (NFIP) payouts

(in million US dollars)

Flood disasters cost insurance carriers millions of dollars in payouts to customers. In 2017, Hurricane Harvey cost the NFIP $8.9 million.

What Does Flood Insurance in South Carolina Cover?

Seeing as flood insurance is sold separately from your South Carolina homeowners policy, you'll have the option to purchase it through the National Flood Insurance Program (NIFP) or limited private insurers. You'll also get to choose whether you want building coverage, contents coverage or both. Each of these will have their own deductible.

These items are typically covered under building coverage

- The building and foundation of your property

- Electrical and plumbing damage

- Finishings, wallboards and built-in cabinets

- Air-conditioning systems, furnaces, and water heaters

- Damage to appliances

- Carpeting and flooring

- Electronics

- Detached garages

- Window blinds and shutters

These items are typically covered under contents coverage

- Clothing, furniture, electronic equipment and other personal belongings

- Curtains

- Washer and dryer

- Portable and window air conditioners

- Microwave oven

- Carpets not included in building coverage (e.g., carpet installed over wood floors)

- Valuable items such as original artwork and furs

Through the NFIP you can insure your house for up to $250,000 and your personal property for up to $100,000. Even if you rent, you can still get flood insurance up to $100,000 for your belongings.

What Additional Coverages Are Available with South Carolina Flood Insurance?

If you have highly valuable possessions like art or jewelry, or detached buildings on your property, you could benefit from additional coverages in your flood insurance policy. While a standard flood policy will cover detached garages, it will not necessarily cover all detached buildings on your property, so you'll need separate insurance for that. The same goes for valuable items. Flood insurance only covers up to $2,500 for valuable items like artwork and jewelry. If you have valued possessions that greatly exceed a value of $2,500, it might be worth looking for additional coverage.

How Much Do Additional Coverages Cost in South Carolina?

Costs vary depending on where you live, but for jewelry, art, and collectibles, you can usually expect to pay 1%-2% of the cost of the value of the item. Detached buildings are more difficult to put a number on because they can vary so greatly in size and purpose. Insurance companies will consider the location, size, value, and risk of the building to determine insurance rate costs.

How Can a South Carolina Independent Insurance Agent Help?

It is becoming more common for homeowners to seek out private insurance companies for flood insurance. A South Carolina independent insurance agent is the perfect partner to help you look at all of your flood insurance options. They can provide a quote from NFIP as well as private companies to see who can offer better rates and coverage. They can also help you discover if you're in a low, moderate, or high-risk flood zone and what that means for your insurance. If you do have to file a claim, your independent agent will be there to help you through the process.

Article Reviewed by | Paul Martin

https://www.southcarolinafloodinsurance.org/flood-facts.php

https://www.lawnstarter.com/blog/water/south-carolina-flood-insurance-data/

https://www.fema.gov/pdf/nfip/manual201105/content/09_prp.pdf

© 2025, Consumer Agent Portal, LLC. All rights reserved.