When you’re on the road, you have a lot to keep in mind at all times. The safety of your own vehicle and passengers is certainly a priority. Unfortunately, not everyone affords you the courtesy you deserve, even in the event of an accident. So what happens if you’re involved in a car accident and the other driver takes off? Who’s responsible for this mess, anyway?

Fortunately, a South Carolina independent insurance agent can not only answer this question for you but also help you get set up with the right South Carolina car insurance. They know just what protection you need in the event of a hit and run, and they’ll get you set up with it long before you ever need to file a claim. But first, here’s how car insurance would work in this scenario.

Who’s Responsible If I Get into a Car Accident and the Other Driver Takes Off?

Unfortunately, the answer to this isn’t clear-cut. Your specific state’s laws will determine the legal fault for hit-and-run accidents. That said, you’re still the one left with the consequences if the other driver takes off, which means you’d need to file a claim through your own car insurance. Fortunately, the right coverage can provide compensation for repairs to your vehicle, and a South Carolina independent insurance agent can help you get set up with the policy you need.

What Does Car Insurance Cover in South Carolina?

Like all other states, South Carolina has its own set of required car insurance coverages for all drivers. These are:

- Property damage liability: This coverage protects against damage to property, like signposts or buildings, if you damage it with your vehicle.

- Bodily injury liability: This coverage protects against injuries to a third party and their passengers if you get into an accident.

- Uninsured motorist coverage: This coverage protects you if you get into an accident with another driver who does not carry any or adequate insurance. For this scenario with the hit-and-run incident, this coverage would be crucial.

Some important but optional add-on car insurance coverages in South Carolina include:

- Comprehensive coverage: This coverage protects against other hazards to your vehicle, including theft and flood damage. Basically, it covers damage “other than collision.”

- Collision coverage: This coverage protects against damage to the driver’s vehicle if they’re involved in a collision.

- Personal injury protection coverage: This coverage provides reimbursement for injuries to the driver and their passengers after an accident.

Speaking with a South Carolina independent insurance agent is the best way to ensure you get set up with all the car insurance you need to protect yourself against hit and runs, and much more.

What Doesn't Car Insurance Cover in South Carolina?

Car insurance provides critical protection for many types of incidents, but it can’t cover everything. Some common coverage exclusions are as follows:

- Business use of the vehicle: If you use your vehicle for business purposes, it needs commercial auto coverage. Personal car insurance policies do not protect your vehicle if it's used for your business.

- Personal belongings stored inside the vehicle: Your car insurance won't cover personal belongings in your vehicle if they get stolen. However, South Carolina homeowners insurance or renters insurance often will provide coverage for personal belongings stored in a car.

- Routine maintenance costs: Routine maintenance costs are considered to be the driver's responsibility and are not covered by car insurance.

- Ridesharing vehicles: If your car is used for a rideshare company such as Uber or Lyft, you'll need a special form of auto coverage known as rideshare insurance. Coverage is sometimes provided by the rideshare company, or it can be purchased as a separate policy.

Your South Carolina independent insurance agent can further explain exclusions under standard car insurance in your area.

Am I Responsible for Covering Any Damage on My End?

Unfortunately, the other driver really didn’t leave you a choice, so yes, it would be up to you to go through your own insurance to cover the damage. You’d have to file a claim under your uninsured motorist insurance to get reimbursement. Make sure to add this crucial coverage to your car insurance policy in case of a hit and run or other incident involving another driver without any/enough car insurance.

How Many Drivers Are Uninsured in South Carolina?

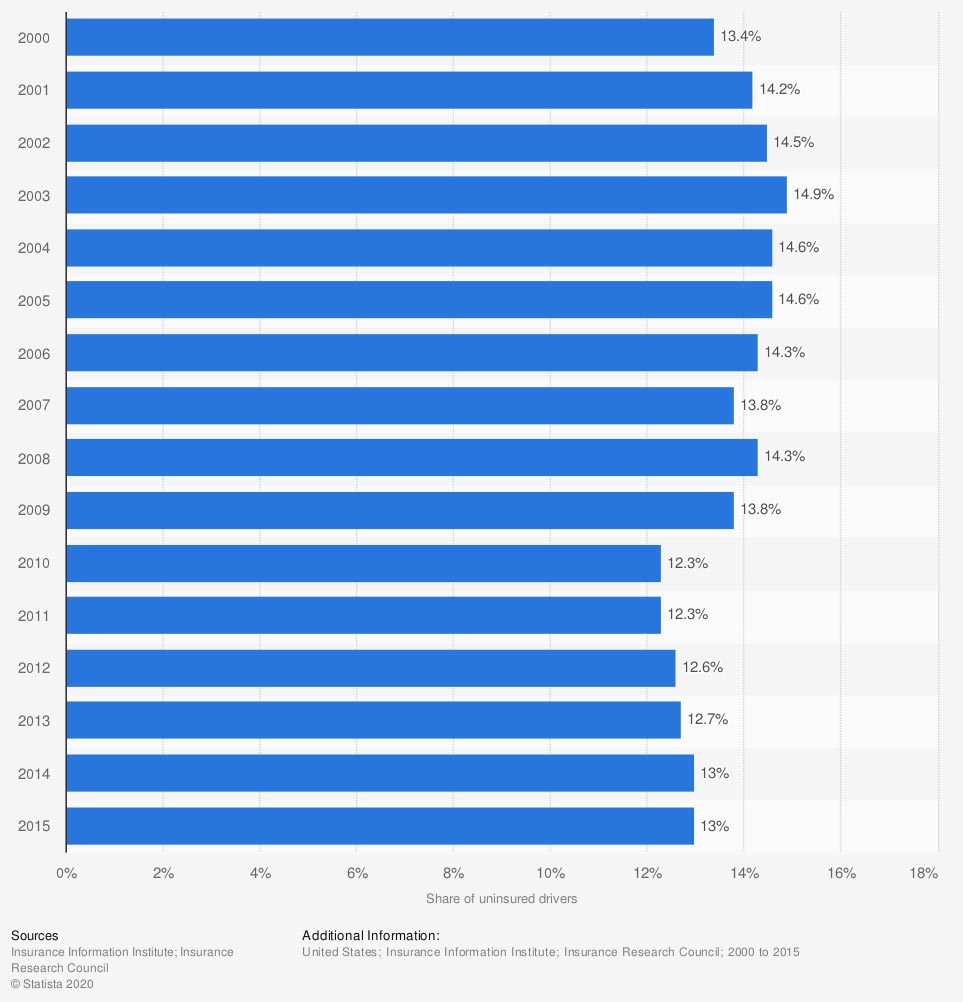

A reported 9.4% of drivers in South Carolina are uninsured. Fortunately, this is below the current national average of 13% . Check out uninsured motorists trend in the US in recent years to further understand why considering scenarios such as this one is critical.

Share of uninsured drivers in the United States from 2000 to 2015

The national average of uninsured drivers has remained fairly consistent over the observed years. At the turn of the millennium, a reported 13.4% of all drivers did not carry car insurance. This number had fallen just a little by 2015, which saw a reported 13% of drivers overall without insurance. This average has remained to this day.

Even though South Carolina’s estimate of uninsured drivers is lower than the national average, there’s still a roughly 1-in-10 chance that a car accident could involve another driver without coverage. That’s why talking with your independent insurance agent about getting the right uninsured motorist coverage is imperative.

Will My Rates Be Affected Even Though I’m Not Responsible for the Crash?

Sadly, your car insurance rates will probably go up, even though you weren’t at fault. For a single incident like this, some car insurance companies can charge as much as a 10% increase in premiums, regardless of whether the policyholder was at fault. You’ll need to ask your independent insurance agent about your state’s specific laws on this, though, since some don't allow car insurance companies to raise rates if the driver wasn’t at fault.

Here’s How a South Carolina Independent Insurance Agent Would Help

When it comes to protecting drivers against hit-and-run accidents and all other incidents, no one’s better equipped to help than a South Carolina independent insurance agent. Independent insurance agents search through multiple carriers to find providers who specialize in car insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Article Reviewed by | Paul Martin

chart - https://www.statista.com/statistics/795555/share-of-uninsured-drivers-usa/

iii.org

irmi.com

© 2024, Consumer Agent Portal, LLC. All rights reserved.