Homeowners need to be prepared for all kinds of unforeseen disasters, even those caused by their own neighbors. Whether intentional or not, damage to your property can still stem from that nice family living next door. So what happens if your neighbor’s lawnmower kicks up a rock and shatters your windshield? Who’s responsible for this mess, anyway?

Fortunately, a South Carolina independent insurance agent can not only answer this question for you but also help you get equipped with the right car insurance. They know just what protection you need in a strange scenario like this, and they’ll get you set up with it long before you ever need to file a claim. But until then, here’s a look at how car insurance would work in this case.

Who’s Responsible If My Neighbor’s Lawnmower Kicks Up a Rock That Shatters My Windshield?

Though the blame would technically fall on your neighbor if their lawnmower kicked up a rock and shattered a parked vehicle’s windshield at your home, it would still most likely be your insurance policy that responded to the damage. This type of incident often needs to go through your car insurance, rather than your neighbor’s homeowners insurance. A South Carolina independent insurance agent can ensure you’re properly covered.

What Does Car Insurance Cover in South Carolina?

Certain types of car insurance are required by law in South Carolina. They are:

- Property damage liability: Coverage reimburses for damage to physical property, like buildings and mailboxes, if it’s struck by your vehicle.

- Uninsured motorist coverage: Coverage reimburses you for accidents involving another driver who does not carry any/adequate car insurance.

- Bodily injury liability: Coverage reimburses for medical costs relating to third-party injuries and the injuries of their passengers if you get into a car accident.

Other important, yet optional, add-on car insurance coverages in South Carolina include:

- Personal injury protection: Coverage reimburses for injuries to the driver and their passengers after a car accident.

- Comprehensive coverage: Coverage reimburses for damage relating to other hazards to your vehicle, including theft and flood damage. Comprehensive coverage reimburses for damage from causes “other than collision.”

- Collision coverage: Coverage reimburses for damage to the driver’s vehicle after a collision.

A South Carolina independent insurance agent will that ensure you get set up with all the car insurance you need to protect yourself against damage caused by your neighbor’s lawnmowing mishaps, and much more.

What Doesn’t Car Insurance Cover in South Carolina?

Car insurance in South Carolina protects against numerous perils, but there are always exclusions. A few of the most common coverage exclusions are:

- Ridesharing vehicles: You’ll need special rideshare insurance for your vehicle if you work for a company such as Uber or Lyft. While coverage is sometimes provided by the rideshare company, it can also be purchased as a separate policy.

- Personal belongings stored inside the vehicle: While South Carolina renters insurance or homeowners insurance often provides coverage for personal belongings stored in a vehicle, car insurance doesn’t.

- Business use of the vehicle: Personal car insurance policies do not protect your vehicle if it's used for business purposes. You’d need a special South Carolina commercial auto policy for that.

- Routine maintenance costs: Tune-ups and other routine maintenance costs are your responsibility as the owner, and are not covered by car insurance.

Your South Carolina independent insurance agent can further explain exclusions under standard car insurance in your area and get you set up with the coverage you need to bridge those gaps, if necessary.

Will My South Carolina Car Insurance Offer Full Coverage for the Damage to My Windshield?

For your car insurance to cover the damage at all, you’d need to have purchased comprehensive coverage. Comprehensive car insurance is the only coverage the reimburses for damage relating to causes aside from collisions. If you didn’t have comprehensive car insurance, you could try filing through your homeowners insurance. No matter which policy you go through, you’ll have to pay the deductible amount out of pocket before receiving any reimbursement.

Comprehensive Car Insurance Stats

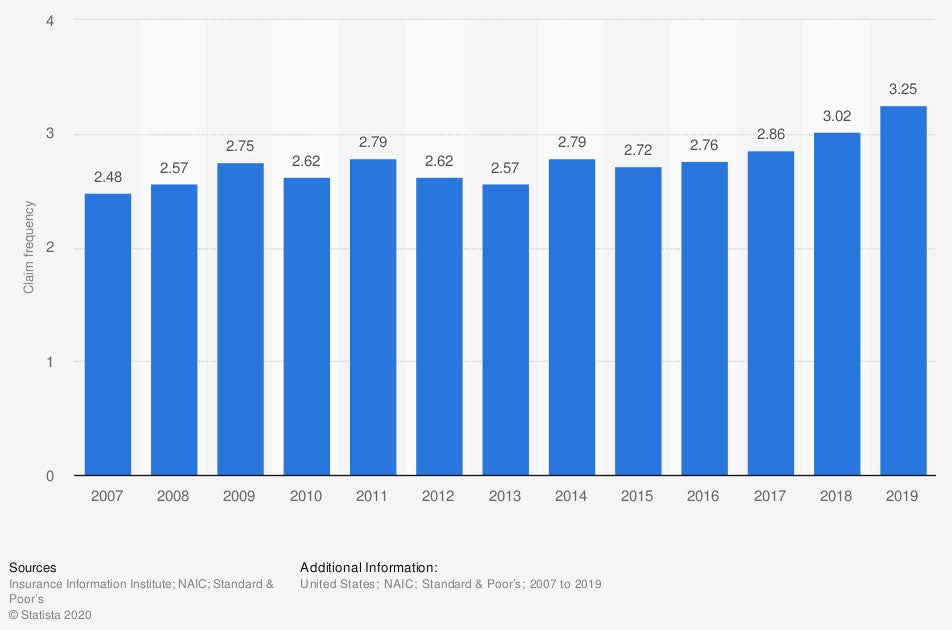

To further demonstrate the importance of having comprehensive car insurance in South Carolina, check out these stats for the frequency of claims filed through this coverage in the US below.

Frequency of private passenger comprehensive auto insurance claims for physical damage in the United States from 2007 to 2019

Comprehensive auto insurance claims in the US have been increasing in frequency in recent years. In 2007, there were a reported 2.48 comprehensive auto insurance claims filed per 100 cars. In 2019, this number had risen to 3.25.

If you’re still unsure of whether you need comprehensive car insurance, a South Carolina independent insurance agent can help you decide.

Am I Responsible for Covering Any Damage Caused by My Neighbor?

Your insurance would be, yes. However, if you lack your own coverage, you could try to get reimbursement through your neighbor’s homeowners insurance, but don’t depend on this option to work. If you were exceptionally angry about the incident and chose to press charges against your neighbor, you’d need to go through your homeowners insurance to file a claim, and would be responsible for paying the deductible amount out of pocket.

It’s important to have the proper car insurance and homeowners insurance coverage at all times, for strange incidents like this one and much more. Without adequate coverage, you could end up paying for damage to your property out of your own pocket. But with the right policy, you’d just have to pay for your deductible before being reimbursed for the rest of the damage.

Here’s How a South Carolina Independent Insurance Agent Would Help

When it comes to protecting drivers against hit-and-run accidents and all other incidents, no one’s better equipped to help than a South Carolina independent insurance agent. Independent insurance agents search through multiple carriers to find providers who specialize in car insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Article Reviewed by | Paul Martin

chart - https://www.statista.com/statistics/830114/comprehensive-car-claim-frequency-physical-damage-usa/

irmi.com

iii.org

© 2024, Consumer Agent Portal, LLC. All rights reserved.