As a homeowner, you need to be on high alert for potential dangers to your home at all times, from the common to the obscure. You also need to ensure that the car parked in your driveway is equipped with the right coverage in case of disaster. So what happens if a neighbor’s tree falls on your car? Who’s responsible for this mess, anyway?

Fortunately, a South Carolina independent insurance agent can not only answer this question for you but also help you get equipped with the right car insurance. They know just what protection you need in a crazy scenario like this, and they’ll get you set up with it long before you ever need to file a claim. But first, here’s a look at how car insurance would protect you in this case.

What Does Car Insurance Cover in South Carolina?

For starters, a few types of coverage required by law in South Carolina:

- Uninsured motorist coverage: This coverage protects you if you get into an accident with a driver who does not carry any or enough car insurance to reimburse you properly.

- Bodily injury liability: This coverage reimburses you for medical costs to other drivers and their passengers if you get into an accident.

- Property damage liability: This coverage reimburses for repair costs to the property you damage with your vehicle, such as buildings.

Some common add-on car insurance coverages in South Carolina include:

- Comprehensive coverage: This coverage protects your vehicle against hazards “other than collision,” including flood damage and theft.

- Collision coverage: This coverage reimburses the insured driver's vehicle for the damage.

- Personal injury protection: This coverage pays for the driver’s injuries and injuries to their passengers after an accident.

A South Carolina independent insurance agent will get you equipped with the right car insurance to protect against falling trees from your neighbor’s house and countless other mishaps.

What Doesn't Car Insurance Cover in South Carolina?

Car insurance in South Carolina protects drivers against many threats, but there are still some coverage exclusions, like:

- Personal belongings: Car insurance policies don’t cover personal property stored in your vehicle if it gets stolen or damaged. However, a South Carolina homeowners insurance policy or renters insurance policy might.

- Business use: Car insurance doesn’t protect your vehicle if you use it for work purposes. For business use of a vehicle, make sure to get the right South Carolina commercial auto insurance.

- Ridesharing vehicles: If your vehicle is used for a ridesharing service, such as Uber, you’ll need special rideshare insurance. Personal auto insurance will not cover this.

- Routine maintenance costs: Car insurance does not cover costs that are deemed the driver’s responsibility, such as routine maintenance and tune-ups.

Your South Carolina independent insurance agent help answer any questions you have about your specific car insurance policy’s coverage exclusions.

Who’s Responsible If a Neighbor’s Tree Falls on My Car?

If you want to get technical, it could be Nature’s fault that your neighbor’s tree landed on your car, whether due to a storm or just aging of the tree. Natural disasters or other “acts of God” do happen, and your neighbor can’t be held responsible for them. Unless, that is, your neighbor had been neglecting a precarious situation, such as a tree that was leaning for a noticeable amount of time. Proving this to an insurance company could be tricky, though.

Will My South Carolina Car Insurance Offer Full Coverage for the Damage to My Car?

To be sure your car would be covered in this scenario, it’d be a good idea to have comprehensive coverage. But according to insurance expert Paul Martin, the property damage section of your car insurance would most likely cover the incident either way. After paying your policy’s deductible amount out of pocket, your comprehensive or property damage coverage will pay for the rest of the damage up to your policy’s limit.

Comprehensive Car Insurance Stats

Just how important is having comprehensive auto insurance? Check out the following stats and see for yourself.

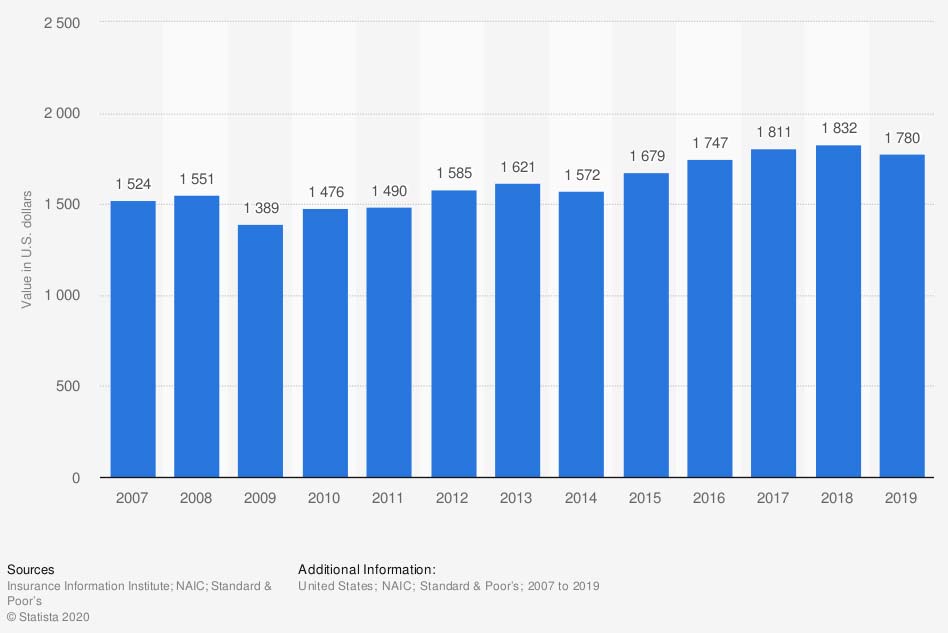

Average value of private passenger auto comprehensive insurance claims for physical damage in the United States from 2007 to 2019 (in US dollars)

While the average size of comprehensive auto insurance claims has remained fairly consistent over the past couple of decades, it has increased slightly since 2007. In 2007, the average comprehensive car insurance claim size was $1,524. By 2019, this amount had increased to $1,780.

Without comprehensive auto insurance, these drivers would have had to pay to cover damage out of their own pockets. If you’re still unsure of whether comprehensive car insurance is a good choice for you, a South Carolina independent insurance agent can help you decide.

Am I Responsible for Covering Any Damage Caused by My Neighbor’s Tree?

Well yes, most likely it’d be your insurance policy that responded to the disaster. That’s why it’s so important to be equipped with all the car insurance protection you need, including comprehensive coverage for incidents like this one. Your homeowners insurance policy probably wouldn’t cover a tree falling on your car, though it would cover damage to a shed or other part of your home. But having car insurance to protect your vehicle is a must.

Here’s How a South Carolina Independent Insurance Agent Would Help

When it comes to protecting drivers against falling trees from their neighbor’s yard and other bizarre incidents, no one’s better equipped to help than a South Carolina independent insurance agent. Independent insurance agents search through multiple carriers to find providers who specialize in car insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Article Reviewed by | Paul Martin

chart - https://www.statista.com/statistics/830189/comprehensive-claim-size-for-physical-damage-usa/

iii.org

irmi.com

© 2025, Consumer Agent Portal, LLC. All rights reserved.