When you run a soybean farm, you want to make sure all aspects of your business are protected. From your crops to your farm’s equipment, there are many different pieces that require their own coverage. Fortunately soybean farm insurance exists to combine all those important protections into one convenient policy.

Perils like fire, natural disasters, riots, and more need to be planned for ahead of time to ensure your business keeps running smoothly. A South Carolina independent insurance agent can help you prepare for the worst and get you set up with all the soybean farm insurance you need. But before we get ahead of ourselves, here’s a closer look at this coverage.

A Breakdown of Soybean Farm Insurance

Like many other types of farm insurance, soybean farm insurance in South Carolina is essentially a fancy form of South Carolina business insurance tailored to meet the needs of soybean farms and their owners. Important coverages like liability, property damage, and more are all rolled into one package created with the risks of soybean farms in mind. Soybean farm insurance covers perils like theft, hail, vandalism, and much more.

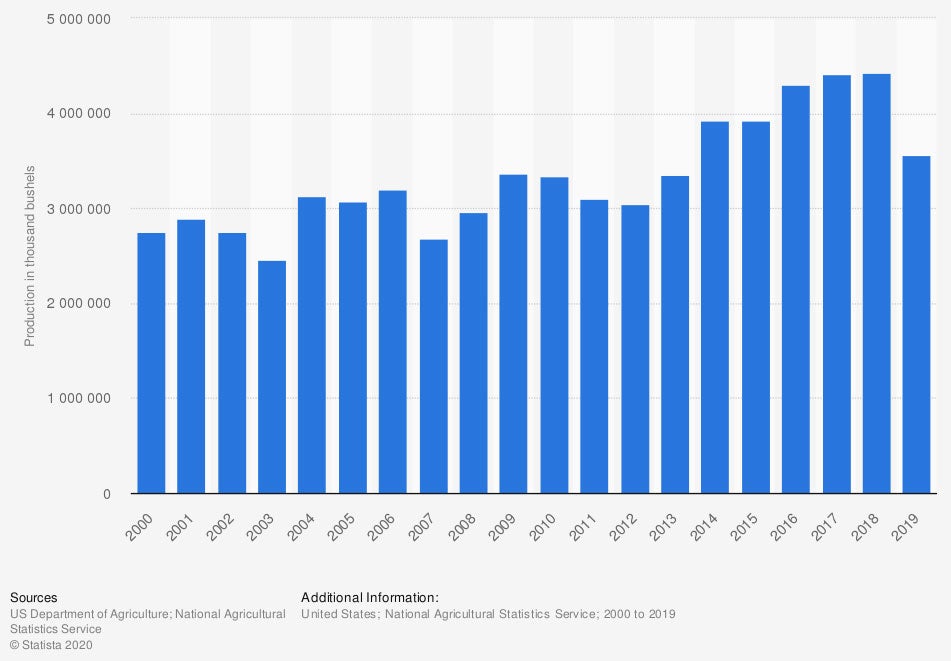

Annual Soybean Production in the US

Production of soybeans (in 1,000 bushels) in the US from 2000 to 2019

In 2019, the US produced an estimated 3.5 billion bushels of soybeans. This was a decrease of nearly one billion bushels from the previous year. However, the production of soybeans was still much higher in 2019 than in the year 2000, when an estimated 2.7 million bushels were produced.

How to Insure a Soybean Farm in South Carolina

In order to get your business the best protection possible, it’s important to work with a South Carolina independent insurance agent who’s experienced in writing coverage for soybean farms. With the help of your independent insurance agent, you’ll work together to create an insurance package that meets all the needs of your unique business and consider all possible risk areas up front. They’ll make sure you walk away with all the coverage you need to get the job done right.

What Soybean Farm Insurance Covers in South Carolina

Soybean farm insurance packages will vary by individual. Since your coverages are handpicked to meet your unique needs, your policy could be quite different from your neighbor’s. Your South Carolina independent insurance agent will help you choose the coverage options that apply to you, but some of the most common protections included are:

- Liability insurance: Farms of all kinds are at risk of being sued by third parties. It’s basically mandatory to have this coverage to protect your business from being bankrupted by unforeseen hefty legal fees.

- Property insurance: Your soybean farm probably has several different types of structures, including fencing, farmhouses, storage sheds, and more. These buildings must be protected from natural elements as well as other threats like vandalism.

- Equipment coverage: Any special equipment your soybean farm uses like mowers, plows, etc. need their own coverage against numerous disasters, since these could get expensive to replace out of pocket.

Some optional coverages to add onto your soybean farm insurance include:

- Worker's compensation: While South Carolina does not legally require agricultural businesses to provide worker's comp coverage for any employees, your hardworking team deserves to be protected against injuries on the job and more.

- Crop insurance: Your soybeans and any other marketable crops need their own protection against perils like freezing, fire damage, theft, and more. Losing a crop without the proper coverage could hit your business extremely hard.

- Commercial auto insurance: Any company vehicles your soybean farm uses must have their own form of protection to reimburse for numerous incidents like traffic accidents, lawsuits, storm damage, and more.

Your South Carolina independent insurance agent can help you create a soybean farm insurance package that best protects your specific business against any possible hazards.

The Cost of Soybean Farm Insurance in South Carolina

Unfortunately there’s no way to estimate your specific soybean farm insurance policy’s cost without considering several different factors. A general rule of thumb, however, is that the more complex your business, the more insurance you’ll require, and the higher your premiums will be.

Some major aspects influencing the cost of your coverage include:

- The total acreage of your farm

- The value and amount of equipment/machinery/tools that need coverage

- The number and size of physical structures that need coverage

- Your specific location*

*Soybean farms located along or near the Atlantic Coast in South Carolina are likely to pay more for coverage than those further inland, due to the increased risk of storms like hurricanes. Your independent insurance agent can help you find exact quotes for your area.

Important Benefits of Soybean Farm Insurance in South Carolina

Not only does your soybean farm need protection, but you as the owner do as well. Soybean farm insurance comes with numerous important benefits. Here are just a few.

- Legal protection: Anyone not employed by your soybean farm who gets injured or suffers from property damage on your business’s premises could press charges against you. Since legal fees are expensive, it’s important to have the right coverage. Liability coverage included in soybean farm insurance reimburses for attorney, court, and settlement fees.

- Physical damage protection: Your soybean farm wouldn’t be much without its many physical structures. In case of a disaster like a hurricane, hailstorm, fire, etc., the property damage aspect of your soybean farm insurance policy would help reimburse for costs relating to the repair or replacement of this physical property.

- Monetary protection: Without the right coverage, just one catastrophe could easily bankrupt a business of any kind. The liability coverage, property damage coverage, optional worker's comp, and more offered by soybean farm insurance provide important protection against bankruptcy to help keep your business running.

Your South Carolina independent insurance agent can explain even more major benefits of having the right soybean farm insurance.

Here’s How a South Carolina Independent Insurance Agent Can Help

When it comes to protecting soybean farms against hazards like hail, theft, vandalism, fire, and all other disasters, no one’s better equipped to help than an independent insurance agent. South Carolina independent insurance agents search through multiple carriers to find providers who specialize in soybean farm insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Article Reviewed by | Paul Martin

https://www.statista.com/statistics/192058/production-of-soybeans-for-beans-in-the-us-since-2000/

irmi.com

iii.org

© 2025, Consumer Agent Portal, LLC. All rights reserved.