When your farm is your livelihood, it’s critical to keep all aspects of it protected. Especially if you have profitable crops, your farm deserves the best coverage against many different risks, from natural disasters to theft and beyond. Fortunately crop insurance is designed to protect your crops from these common threats and much more.

A South Carolina independent insurance agent can help you find the right kind of crop insurance for your specific farm. But before we get too far ahead of ourselves, here’s a deep dive into this important coverage.

What Is Crop Insurance?

While there are a couple different kinds, crop insurance in South Carolina on the broader scale is basically a special form of South Carolina business insurance designed to protect crops against many different hazards. Depending on the type of crop insurance you purchase, your crops will be covered against several threats included in your policy. A couple of the most popular forms of crop insurance include crop-hail insurance and multiple peril crop insurance. More on this in just a moment.

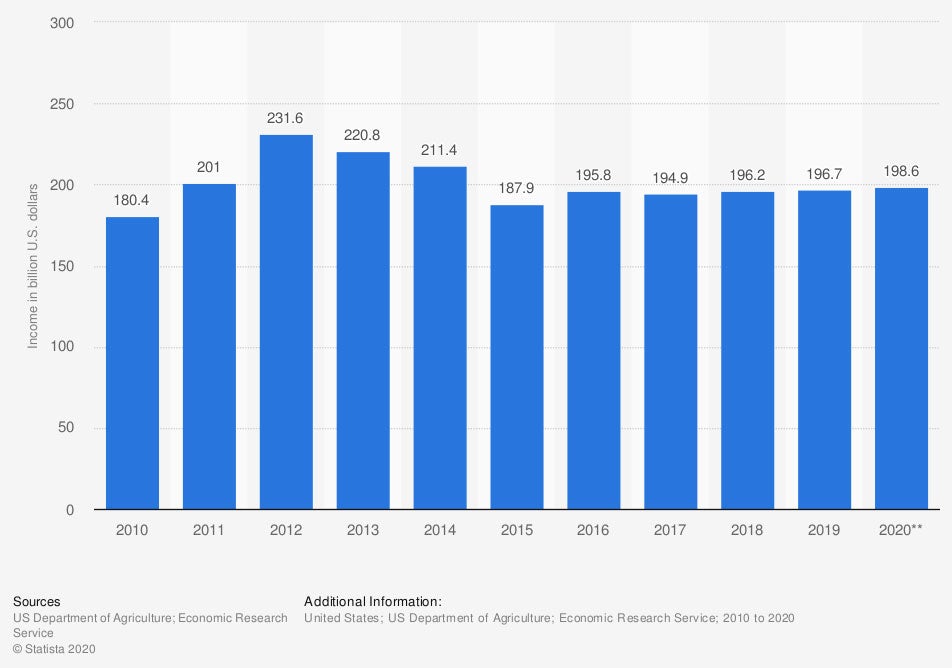

Annual US Revenue from Crops

Total US farm income from crops between 2010 and 2020

The average income generated by crops for farmers has remained fairly steady over the past few years, with an increasing trend since 2017. In 2020, farmers made a reported $198.6 billion from crop income alone. This was an increase of more than $18 billion compared to the year 2000.

What Does Crop Insurance Cover in South Carolina?

That will depend on the specific type of crop insurance you purchase. You’ll want to work with a South Carolina independent insurance agent to ensure that you walk away with the coverage that best protects your crops. The two of you will assess the hazards that could most threaten your unique farm in order to determine which policy is right for you.

What Is Multi-Peril Crop Insurance?

Multiple peril crop insurance is sold by the federal government, under the Federal Crop Insurance Program. This coverage needs to be purchased before crops are planted in order to be effective. Multiple peril crop insurance provides important protection for crops against many natural threats, including:

- Insect damage

- Disease outbreaks

- Drought

- Fire damage

- Flood damage

- Other natural disaster damage (e.g., hail, high winds, frost)

This form of crop insurance needs to be renewed for every subsequent growing season after the policy is activated. Multiple peril crop insurance is by far the most popular form of coverage chosen by farmers in the US. An independent insurance agent can help you decide if this is the right protection for your farm.

What Is Crop-Hail Insurance?

A crop-hail insurance policy is also designed to protect crops against natural threats, but with a more limited scope. The two major perils covered under crop-hail policies are hail damage and fire damage. Since crop-hail policies are sold acre by acre, farm owners can choose to only purchase this coverage for certain areas of their farm that may be at higher risk of damage. However, coverage cannot be transferred to another section of crops later on.

Farm owners can also opt to add other protections to their crop-hail policies to increase their coverage. They can select coverage for the following disasters:

- Wind

- Vandalism

- Malicious mischief

- Lightning

- Frost

- Theft

A South Carolina independent insurance agent will be able to help you decide if crop-hail insurance is the right choice for your farm. They’ll also be able to help you determine which coverages, if any, would be beneficial to add to your policy.

What Doesn't Crop-Hail Insurance Cover in South Carolina?

Crop-hail insurance is designed to protect against some of the most common and destructive threats nature can throw at a farm, but no policy can protect against everything. This coverage often excludes coverage for the following disasters:

- Flood damage

- Changes in crop value

- Excess moisture

- Drought

One reason so many farmers opt for multiple peril crop insurance over crop-hail insurance is that it provides protection for hazards that are excluded by crop-hail insurance, including flood damage and drought.

How Much Does Crop Insurance Cost in South Carolina?

Unfortunately that can be difficult to estimate. The cost of your crop insurance policy will be determined by a bunch of different factors, including your farm’s exact location and that area’s risk of natural disasters. Other factors include:

- The type of crops

- The value of the crops

- How many acres need coverage

- Any additional coverages purchased

Farms located close to the Atlantic Coast of South Carolina are likely to require more expensive coverage than those located further inland, due to the increased risk of storms like hurricanes. Your South Carolina independent insurance agent can help you find exact quotes for the different types of crop insurance available in your area.

Here’s How a South Carolina Independent Insurance Agent Can Help

When it comes to protecting farms and their crops against hazards like fire, hail, vandalism, and all other disasters, no one’s better equipped to help than an independent insurance agent. South Carolina insurance agents search through multiple carriers to find providers who specialize in farm insurance and crop insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Article Reviewed by | Paul Martin

https://www.statista.com/statistics/196425/us-farm-income-from-crops-since-2001/

irmi.com

iii.org

© 2024, Consumer Agent Portal, LLC. All rights reserved.