When you own a piece of land, there's nothing quite like having a slice of the American pie. Protection for your property is another story and should be taken into serious consideration to avoid financial ruin. There are numerous South Carolina business insurance companies on the market, making finding the proper farm coverage crucial.

Fortunately, a South Carolina independent insurance agent has the answer. They work with multiple carriers, getting you the best policies in town for an affordable cost. Connect with a local expert to start saving today.

What Is Farm Insurance?

It's important to know how your farm insurance works before a loss arises. Take a look at which exposures can be covered under farm insurance in South Carolina:

- Farm insurance: Several insurance policies could fall under farm coverage. Liability, property, equipment, crop, livestock, and homeowners are the typical options you'll be met with when deciding on coverage.

The Best Farm Insurance Companies in South Carolina

The best is relative. What works for your farm may not for some else's operation down the street. Which carrier your South Carolina farm goes with can be reviewed by a professional for accuracy.

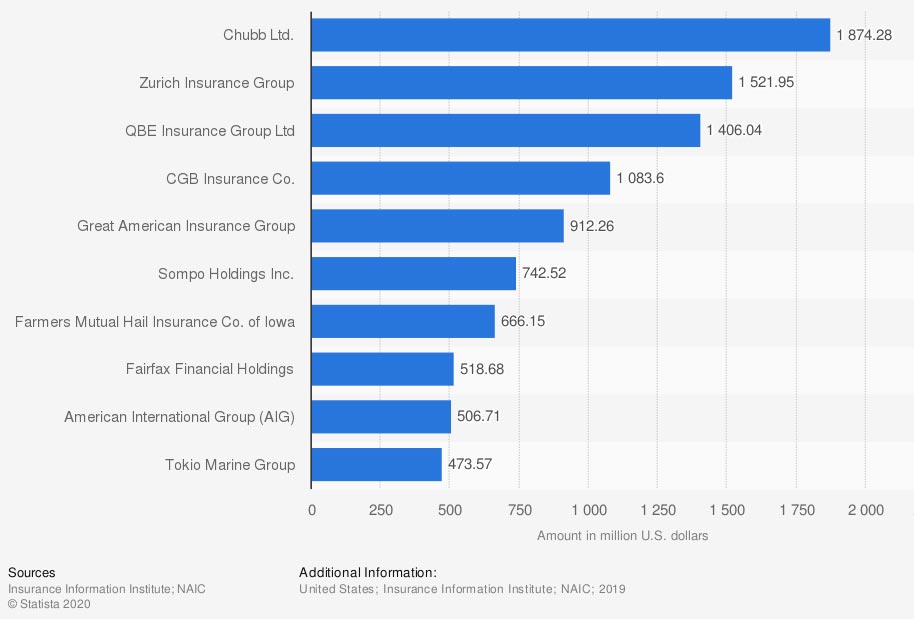

Largest multiple peril crop insurance companies in the US, by direct premiums written

Where other farmers are placing their coverage is very telling. Multiple peril crop insurance in the US is a federal government-funded policy for farmers and is necessary if you're in the business of growing crops for distribution.

How Much Does Farm Insurance Cost in South Carolina?

The value of private crop-hail insurance coverage in South Carolina is $7,200,000. Each policy for your farm will be unique to your individual risk factors. Carriers calculate your costs by using the information below:

- Prior losses

- Value of farm equipment and property

- Value of crops

- Your age and experience

- Length of time with the previous carrier

- Local crime rate

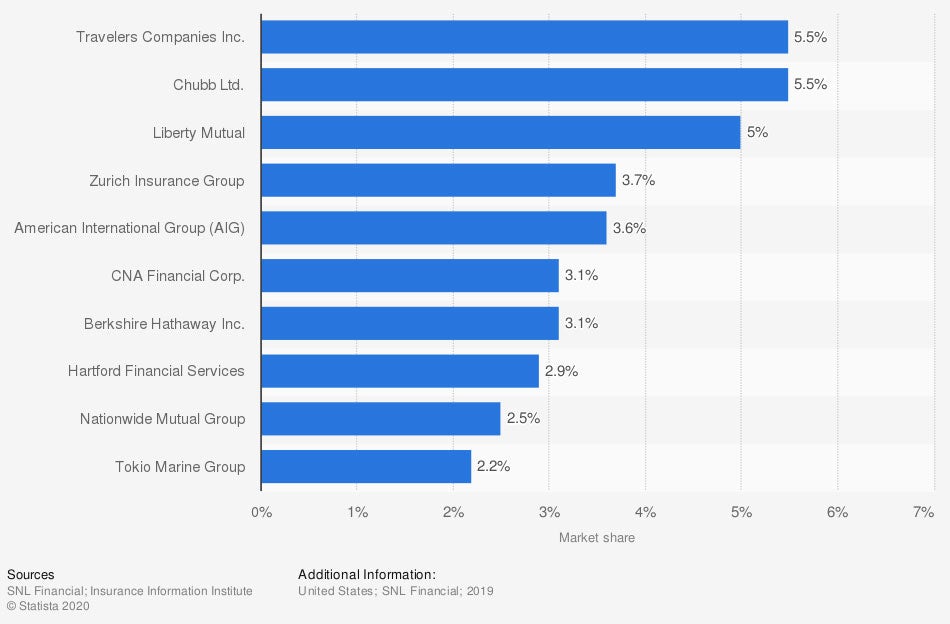

Market share of commercial lines insurance companies in the US, by direct premiums written

While each carrier has something different to offer, it's good to know what your peers choose. What's best for your farm may not be for another, so tailored protection is vital.

What Do Farm Insurance Companies Offer in South Carolina?

In South Carolina, your farm will need basic coverages to get started. From there, you and your adviser can tailor your policy to your specific needs. Take a look at foundational coverage options to consider for your farm:

- Liability: A general liability policy will provide bodily injury and property damage coverage.

- Commercial property: This policy covers your farm structures and pole barns, and can even insure your equipment.

- Business interruption: If you have to close down due to a covered loss, this coverage will foot the bill for regular expenses for a specified period.

- Accidents: This can be anything from coverage for electrocution, fire and smoke, to loading and unloading of livestock.

- Natural disasters: Volcanic eruptions and sinkholes are covered. Typically floods and earthquakes are covered under separate policies.

- Weather events: Lightning, wind, hail, tornadoes, and more.

- Crimes and civil unrest: This is for theft and vandalism of livestock.

- Crops: There are a couple of different crop policies you can obtain. All will cover various types of damage to your crops and reimburse for their value if necessary.

When Is the Best Time to Buy Farm Insurance in South Carolina?

The best time to get coverage for your South Carolina farm is the minute you own the farm. To get started, your adviser will need to know some of the following information:

- Your herd's specifics: You'll need to cover the risks that are specific to your herd. Horses will have different needs from cattle and so on.

- What your livestock is worth: This is the value you can get in the marketplace for your livestock. You are covering the risk of the replacement cost if something happened to them.

- If you have crops: If your farm deals with planting and producing crops, you'll need separate crop insurance.

- Other structures and buildings: If you have a home, pole barns, and more on your property, you'll need coverage for the buildings themselves.

- What preemptive protection you have in place: Carriers will want to know how you are proactive, such as if you are accounting for the risk of predators by having fencing and more.

How a South Carolina Independent Insurance Agent Can Help

If you're in the business of farming, the right policies are necessary to run a smooth operation. You'll have options on coverage that may seem overwhelming if you're not a licensed professional. Fortunately, you're not alone, and your policies can be reviewed for free by an adviser.

A South Carolina independent insurance agent does the shopping while you sit back and relax. They'll find a policy through their network of highly rated carriers, giving you coverage and low rates. Connect with a local expert on trustedchoice.com for custom quotes in minutes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/689397/largest-mpci-companies-usa-by-direct-premiums/

https://www.statista.com/statistics/186464/leading-us-commercial-lines-insurance-by-market-share/

http://www.city-data.com/city/South-Carolina.html