Taking safety precautions when operating a watercraft is second nature to many seasoned boaters, especially when the boat doesn't belong to them. Accidents can still happen, though, no matter how safely you operate a vessel. So what would happen if you caused an accident with a boat you rented?

While a South Carolina independent insurance agent can help you get protected with the right kind of boat insurance, we can start by helping to answer this question. Here's a closer look at who'd be responsible for a boat accident if one was rented.

Are Boating Accidents Common in South Carolina?

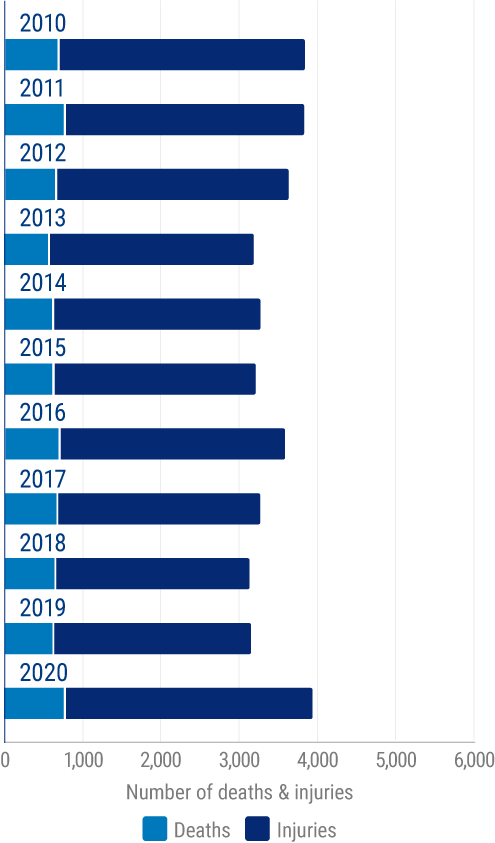

Boating accidents are not only more common in South Carolina than you might expect, but in the US as a whole. The number of deaths and injuries caused by boating accidents annually may be shocking. Check out the graph below and see for yourself.

Number of deaths / injuries directly linked to boating accidents in the US

In one recent year, there were a reported 767 deaths caused by boating accidents, and 3,191 related injuries. These numbers are up quite a bit from the previous year, which reported a total of 613 deaths and 2,559 boating accident injuries. Though these incidents had fallen for a few years, they're once again on the upswing.

Knowing how frequently deaths and injuries occur from boating accidents helps shed light on the importance of being protected from the unexpected. A South Carolina independent insurance agent can help by equipping you with the right boat insurance policy.

Who’s Responsible in a Boating Accident If One’s a Rental?

Technically it would be the person at fault for the accident, similar to if both boats were owned. The only thing boat ownership vs. rental status changes is how an accident is handled. Depending on your specific boat insurance policy, you may or may not be covered if you rented the boat you caused an accident with.

Homeowners insurance often provides coverage for boating accidents as long as you didn't rent the boat, but borrowing a boat is covered. If you rented the boat from a business, they probably have their own insurance, but it might not cover you as the operator, only them as the owner. There are a lot of caveats in this unique situation, and it would depend entirely on your insurance company whether you had coverage for a rented boat.

How Can Insurance Help Protect My Boat?

When you own your boat, a boat insurance policy can help protect you in many ways. From collision damage to liability, boat insurance offers many important coverages, like:

- Collision: Covers physical damage to your own boat after an accident that you caused.

- Comprehensive: Covers your boat for threats other than collision, including various kinds of weather damage, vandalism, and more.

- Property damage liability: Covers property damage you cause to others with your vessel, including to another boat, a dock, fencing, etc.

- Bodily injury liability: Covers bodily injuries you cause to others with your vessel, in accidents and more.

- Emergency assistance on the water: Covers a tow if you unexpectedly break down on the water.

If your boat gets totaled in an accident or other disaster, how much you'd be reimbursed for the watercraft depends on your specific policy. Some policies require boat owners to come to an agreement with the insurer for the boat's value at the start of their coverage. Other policies offer actual cash value coverage, which factors in depreciation at the time of an incident.

What Doesn't Boat Insurance Cover?

The exclusions of your boat insurance also really depend on your specific policy. Boat insurance isn't standardized, which means policies can vary greatly from boater to boater. You might find that your policy restricts something like operating under the influence.

States dictate their own laws for the age when a boat operator is allowed to be without restrictions, which influences a boat insurance policy's exclusions as well. In South Carolina, those aged 16 and older can operate a boat without restrictions. For younger boaters, they either have to pass an official safety course or be accompanied by someone 18 or older before they can operate a watercraft.

Can I Extend My Coverage Beyond the Existing Limits?

You might be interest in adding more coverages to your boat insurance policy beyond the core protections already included. Some add-on coverages or endorsements might include:

- Watercraft equipment coverage: Offers protection for fire extinguishers, life vests, and other equipment you bring on your vessel, up to a limit.

- Accessories coverage: Offers protection for fishing tackle, rods, lures, etc. up to a limit.

- Competition coverage: Offers protection for incidents that may arise if you use your boat in competitive settings.

- Commercial liability coverage: Offers protection for boat operators who transport the public with their boat as a service.

- Crew liability coverage: Offers protection for injuries to a boat's crew.

You can also work with your South Carolina independent insurance agent to increase your existing boat insurance policy's limits in each category, or to increase the coverage limits offered for endorsements like accessories coverage. These add-on coverages often come with low limits of around $1,000.

If I’m the Owner of the Boat Rented, How Do I File a Claim?

If your boat gets damaged by a renter or even an act of nature like a hurricane, it's important to file a claim through your boat insurance ASAP.

Take the following steps to file a boat insurance claim:

- File a report: File a report with the local authorities after a boat accident, especially if there are injuries involved.

- Document all damage: Take pictures, videos, etc. to document any new damage to your boat.

- Make necessary repairs: If necessary for your safety or the safety of others, have repairs made to your boat and keep copies of your receipts for your insurance company.

- Gather all documents: Before contacting your independent insurance agent, make sure you have a copy of the police report if applicable, your photos or videos of any damage, and your receipts for immediate repairs.

- Call your agent: Contact your South Carolina independent insurance agent and explain the situation in depth. From there, they can contact your insurance company for you.

- Stay calm: Your South Carolina independent insurance agent will keep you updated through every step of the claims process, including providing you with a timeline for when various steps will be completed and when you should receive reimbursement.

If you ever need a refresher on the claims process, your South Carolina independent insurance agent can help.

Why Choose a South Carolina Independent Insurance Agent?

South Carolina independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut the jargon and clarify the fine print so you know exactly what you’re getting.

South Carolina independent insurance agents also have access to multiple insurance companies, ultimately finding you the best boat insurance coverage, accessibility, and competitive pricing while working for you.

Author | Chris Lacagnina

https://www.statista.com/statistics/240614/recreational-boating-accidents-in-the-us--number-of-deaths--injuries/

https://uscgboating.org/library/accident-statistics/Recreational-Boating-Statistics-2020.pdf

https://www.iii.org/press-release/iii-know-your-boats-insurance-coverage-from-stem-to-stern-051619

https://www.boat-ed.com/southcarolina/boating_law/#:~:text=South%20Carolina%20Boating%20Laws%20and%20Regulations&text=Persons%2016%20years%20of%20age,than%2015%20hp%20without%20restrictions.

© 2025, Consumer Agent Portal, LLC. All rights reserved.